2030 arrives in 2020

Chris Skinner

JUNE 2, 2020

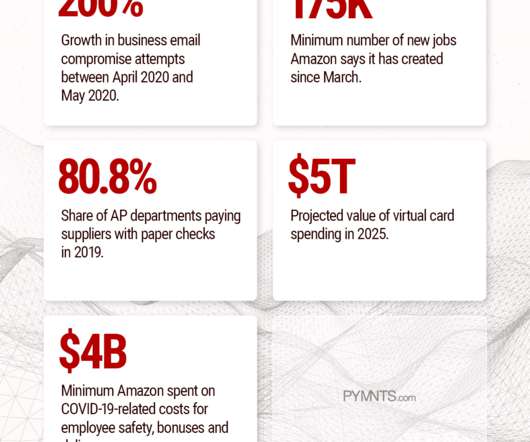

This is it … In one month, retail sales jumped massively from 16% to 27% of all sales. Other facts and figures that made me smile were Amazon’s retail sales jumping 24% in … The post 2030 arrives in 2020 appeared first on Chris Skinner's blog. I got a chart this week that made me smile.

Let's personalize your content