Payments players caught in venture capital squeeze

Payments Dive

APRIL 12, 2022

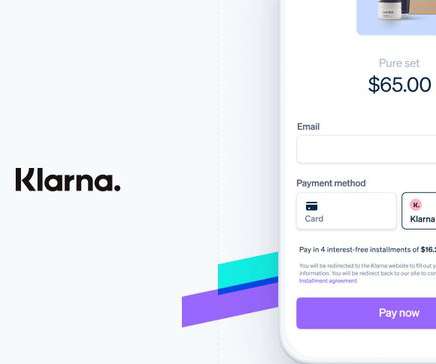

The flow of venture capital to startups ebbed in the first quarter for the biggest quarterly decline since 2012. Payments players, which have been big beneficiaries of such investments, are beginning to feel the pinch.

Let's personalize your content