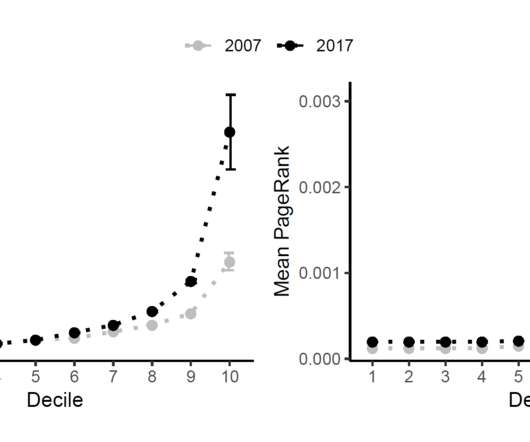

NatWest reports biggest annual profit since 2007 financial crisis

TheGuardian

FEBRUARY 15, 2024

That is the highest annual profit recorded since it made £10bn in 2007, the year before excesses led to a public rescue that has yet to be fully unwound 16 years later. The UK lender – which is still 35% government-owned – said pre-tax profits rose 20% to £6.2bn in the year to December. Continue reading.

Let's personalize your content