Today’s Bank Secrecy Act (BSA)/anti-money laundering (AML) and fraud departments are busier than ever. On top of managing ever-changing regulations and more complex financial crime schemes, COVID-19 has created even more obstacles for BSA/AML and fraud departments to juggle. To benchmark the industry’s challenges and key areas of focus, Abrigo polled more than 300 BSA/AML and fraud professionals in its inaugural 2021 FinCrime Industry.

Top Challenges and Hot Topics: Key Considerations for Today’s BSA/AML Professionals

August 4, 2021

Read Time: 0 min

Survey: Top Challenges and Trends for BSA/AML Professionals

Abrigo's 2021 FinCrime survey benchmarks obstacles and trends for BSA/AML and fraud professionals.

Takeaway 1

Managing false positives and keeping up-to-date on regulatory changes continue to be a challenge for financial institutions.

Takeaway 2

Banking cannabis-related businesses and cryptocurrency are two hot topics in the BSA/AML and fraud space.

Takeaway 3

COVID-19-related fraud has reignited conversations around combining BSA/AML and fraud departments.

BSA/AML Challenges

Top obstacles vary depending on institution’s size

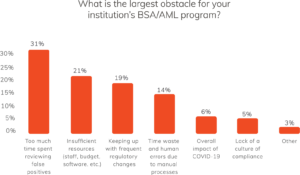

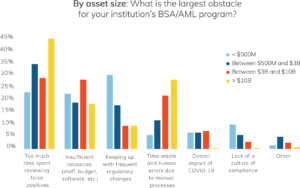

Managing the volume of alerts is a common challenge for BSA officers – especially when many of those alerts are false positives. Nearly one in three respondents said their BSA/AML program spends too much time reviewing false positives, making it the top obstacle for financial institutions for those surveyed.

While this was the most commonly reported obstacle overall, a deeper dive into the data reveals that financial institutions under $500 million are particularly hamstrung by changing regulations – the top obstacle reported for this asset size. A key reason for these obstacles may be attributed to the lack of resources financial institutions have access to – the second most common obstacle reported – including staff, a sufficient budget, and software.

What problems are compliance professionals facing today? See the full 2021 FinCrime Survey Results.

Learn More

BSA/AML Trends

The jury's still out on cannabis and cryptocurrency

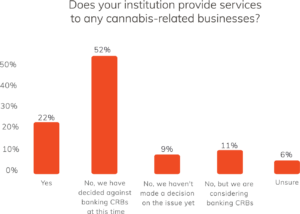

Although cannabis is now legal – either medically or recreationally – in most states today, it remains illegal on a federal level, hamstringing cannabis-related businesses (CRBs) from accessing traditional financial accounts. As this industry continues its rapid expansion, it is increasingly important that it has access to traditional banking services. However, there are not many financial institutions willing to take the risk at this time. Just 22% of financial institutions said that they are currently banking CRBs. However, 11% of those surveyed reported that their financial institution is still considering banking CRBs. These institutions could help satisfy the increase in demand for these services. Understandably, there are still many financial institutions that are skeptical of the risk. Nearly three-quarters of respondents are not currently banking CRBs. While some financial institutions are still weighing the decision, half of the respondents reported that their financial institutions have decided against banking CRBs.

Perhaps even more vexing than banking CRBs is understanding how to handle cryptocurrency. Currently, there are no federal guidelines on banking cryptocurrencies, and it is up to each institution to set policies and procedures for banking cryptocurrencies. Only a third of respondents said that their financial institution had tailored customer due diligence questions or other KYC/KYT measures in place to identify cryptocurrency customers, and only 8% are currently handling any cryptocurrency- or virtual currency-related businesses.

Other BSA/AML Considerations

COVID-19 reignites questions over combining BSA/AML and Fraud departments

Some financial institutions choose to keep their BSA/AML and fraud departments under the same umbrella, while others choose to keep them separate. Overall, two-thirds of respondents said that their financial institution’s BSA department also covers fraud. Perhaps not surprising due to limited resources, it was more common for smaller institutions to combine the two departments, while larger institutions kept them separate. Eighty percent of institutions with less than $500 million in assets combined the two departments, and 70% of institutions with assets between $500 million and $3 billion combined departments. Meanwhile, more than 50% of financial institutions greater than $3 billion kept their departments separate.

Download your complimentary PPP Fraud Detection Checklist.

Download nowWhile there is no right or wrong answer, COVID-19 highlighted the benefits of having the two departments working together. Economic relief payments are often subject to fraud, and the Paycheck Protection Program (PPP) and other government stimulus payments were no exception. Many AML professionals were catching PPP fraud with AML software. In many cases, fraud teams were overloaded with COVID-19-related fraud. “Fraud was maxed-out workload-wise, and our BSA team had to jump in,” one panelist said during the recent Advantages and Disadvantages of Combining BSA/AML and Fraud Departments session at ThinkBIG 2021. “The two departments were sharing responsibilities and were in constant communication with one another.”

With the Anti-Money Laundering Act of 2020 passing earlier this year, continued COVID-related fallout, and other emerging FinCrime trends, BSA/AML professionals have a lot on their plates. It’s critical that they have access to the resources necessary to keep their institution and its customers and members safe and sound, and the tools in place to allow them to focus on the issues at hand.

For a deeper dive into the 2021 FinCrime Survey, attend Abrigo’s complimentary webinar on August 26 at 2 p.m. ET.

About the Author