Other parts of this series:

Summary: High human care can unlock people’s potential and drive business performance. Even in a weak economy, your organization could gain 5 percent revenue growth—just by taking care of your people.

What are the best indicators of someone’s potential at work? If you said education, tenure, job level, industry, geography or company size, you’d be partly right. Our research found that these factors account for 9 percent of someone’s work potential.

Nine percent is good. But what if you could do better—drastically better?

Well, you can.

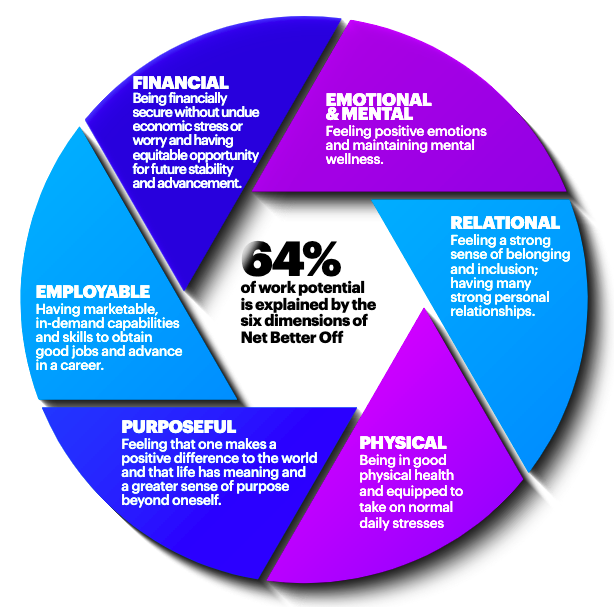

Accenture’s Care To Do Better study found that you can account for 64 percent of people’s potential at work by meeting six fundamental human needs: emotional and mental health, physical health, relational wellbeing, purpose, financial stability and employability.

These needs are captured by Net Better Off, a measure of an organization’s capability to take care of its people. Think of it as the people equivalent of a Net Promoter Score.

Even in today’s economy, your organization stands to gain 5 percent revenue growth—just by taking care of your people.

Six factors can help banks unlock people’s potential

Our Care To Do Better research comes when many banks are restructuring, divesting and merging. For example, we’d previously found that North American banks risk up to 15 percent of their payments revenue—that’s an estimated $88 billion—due to competition from non-banks that are innovating in the payments space. This trend has accelerated during the pandemic as people eschewed cash for instant, invisible and free digital payments.

Similarly, COVID-19 has accelerated many workplace trends. Before the pandemic, fully remote teams and virtual workplaces were the stuff of technology start-ups, not incumbent players. But last March, the majority of banks shifted to a remote workforce within weeks, if not days. Where cloud used to be a piece of the digital transformation puzzle, suddenly it became an essential way for organizations to be agile and focus on serving employees and customers, rather than maintaining and evolving software capabilities.

In other words, the pandemic has accelerated many existing banking and workplace trends. There’s hope on the horizon as vaccines start to be rolled out, but there’s still a lot of variation in the world. Whether you’re under lockdown or returning to some semblance of normal, it bears thinking about what we’ve learned—and are learning—from the pandemic, and how we can do things differently.

Chief among the things we can do differently: By meeting six fundamental human needs through work, your company can unlock people’s full potential. It bears repeating that 64 percent of a person’s potential at work can be accounted for by six factors.

In addition, we found that 73 percent of the banking workforce said they strongly believe their employer is responsible for helping them achieve Net Better Off. But only 30 percent of the banking C-suite agrees. Compare this to 75 percent and 50 percent, respectively, in our cross-industry findings.

In other words, there’s a greater disconnect between the banking workforce’s expectations for high human care and what their CXOs believe they’re responsible for delivering.

So, what can you do about it? Let’s look at each of the six dimensions in more detail. They pose some brilliant questions for you to start helping your people be Net Better Off.

Emotional and mental health

The pandemic has highlighted the importance of feeling positive emotions and maintaining mental wellness, and 65 percent of the banking workforce believes their employer should be responsible for helping them in this area. Yet, there’s still stigma around mental health. As my colleagues Barbara Harvey and Cengiz Besim discussed on the Human podcast, 92 percent of workers have been touched by mental health in some way—and that was before COVID-19. Further, 6 out of 10 workers don’t say anything about their mental health when they’re at work, especially those under the age of 25.

What to ask today to be better off tomorrow:

- How can we support the ongoing mental resilience of our people when the potential trauma from the crisis may have lasting effects?

- How can we create a more open conversation about mental health and support people when they speak up?

Physical health

Physical health refers to people being fit, healthy and relatively stress-free, and 63 percent of the banking workforce expects their employer to be accountable in this area. For example, consider that Peloton expected to hit a billion dollars in holiday sales. That’s a lot of spinning, and it’s likely this increased focus on physical health and wellness will continue post-pandemic.

Right now, the focus on safe workplaces is especially important for workers in public-facing roles, for whom work-from-home isn’t possible. Moving forward, it’ll also be about being confident in your company’s ability to return to a hybrid model of working from home and office. It’s also about helping workers manage stress. Consider that our 2020 Global Digital Fluency Study found that in banking, 31 percent of employees are stressed by the amount of change their company is asking them to make, and 29 percent are struggling with “digital overload” at work.

Just as the pandemic has forced many companies to think about their workers’ mental health, it has sparked more awareness of people’s physical needs. The shift to work-from-home and flexible hours has increased accessibility for people with physical disabilities, which is an integral—but often overlooked—part of the diversity puzzle. As workplaces become more digital, they also become more accessible by design. Many organizations are making the effort to create meaningful change when it comes to gender and racial inequality, which is terrific and long due. In addition, I encourage you to think about whether your workplace is inclusive for people with physical disabilities.

What to ask today to be better off tomorrow:

- What have we learned about our peoples’ physical wellbeing that should be adopted as practices moving into the future?

- How do we create safe and active workplaces, whether we are at home or back in the office (or more likely, a bit of both)?

Relational wellbeing

Relational wellbeing focuses on our sense of belonging and feeling included, with 75 percent of the banking workforce believing their employer should be accountable in this area. Relational wellbeing happens when someone has many strong personal relationships. The foundation for relational wellbeing is trust and psychological safety.

And there’s good news. Our digital fluency research found that 74 percent of the banking workforce has a sense of belonging to a group, 73 percent are on a team that shares and exchanges ideas frequently and openly and 71 percent agree the quality of team communications is supported by digital technology. In addition, 75 percent of workers say they enjoy getting to know other members of their team, both professionally and personally, and 70 percent are known for their ability to relate to others.

Relational wellbeing is especially important for remote workers, because it’s not as easy to see who’s included—and excluded—from the virtual team and networks.

Key point: you have to work harder to maintain relational wellbeing on remote teams. There’s a certain serendipity that happens in the office, whether from seeing someone in the break room or taking impromptu walks with colleagues. These things happen naturally when you share a workspace; but when you work remotely, you have to make them happen. The idea of engineering “superconcentrated serendipity” came up in this conversation with Matt Kingdon, co-founder of ?WhatIf! Innovation and Oli Barrett, a serial entrepreneur.

What to ask today to be better off tomorrow:

- How do we create a sense of belonging on virtual teams?

- How do we ensure every voice is being heard throughout our organization?

- How can we enable better choice and avoid a “new presenteeism?”

Purpose

Increasingly, purpose is becoming a strategic business imperative, with 73 percent of banking workers holding employers accountable in this area. For example, roughly one in two consumers agree the ethical, sustainable and moral values that a company holds will become more important to them after the pandemic passes. In addition, Accenture Strategy’s global consumer survey found that 62 percent of customers want companies to take a stand on issues like sustainability, transparency or fair employment practices.

62 percent of customers want companies to take a stand on issues like sustainability, transparency or fair employment practices.

This is about much more than just a set of environmental, social and corporate governance (ESG) values on a website. It means creating truly responsible, sustainable and purpose-driven brands. It means connecting financial services to their original roles in society, such as providers of security, investments and credit (enabling our lives and key life or business goals), facilitating payments and trade (enabling economic growth and value) or pooling risk (providing individuals and businesses security and the ability to take bigger risks and innovate).

An organization’s sense of purpose must also be congruent with that of its workers. Namely, when people feel like they’re making a positive difference to the world, that gives their lives meaning and connects them to something bigger than themselves. In addition to this big-picture purpose, individuals must also have meaningful day-to-day work. Here in the UK, the Taylor Report highlighted the importance of meaningful work as part of “good work.”

This congruence, or lack thereof, has been an issue in financial services since the 2009 financial crisis. However, when purpose is managed for social good, financial institutions can have a huge positive impact on the world. Here in the UK, HSBC offers bank accounts for people with no fixed address and the Nationwide Foundation invests in community housing. In the US, U.S. Bank offers community grants, the Citi Foundation provides funding for community development groups and the TD Bank Group funds environmental projects across Canada.

And more good news: roughly two-thirds of banking workers say they can relate their daily activities to the overall direction of their current project (67 percent) and that they’re excited about the direction of their current work (65 percent).

What to ask today to be better off tomorrow:

- How does our purpose evolve to meet an enlightened workforce and customer?

- How does our purpose come to life in our communities?

- As work is disrupted, how do we create more meaningful and purpose-filled work for the people who are retained?

Financial stability

When people feel financially secure, without undue economic stress or worry, they can be free to unlock their full potential. Financial security also means having equitable opportunity for future stability and advancement within your company, and 78 percent of the banking workforce believes their employers should be accountable in this area. This was part of our impetus for launching People + Work Connect, which has helped move tens of thousands of people between under- and over-capacity industries.

The good news: Of the six components that unlock people’s full potential, this one is on most companies’ radar.

The bad news: Of the six components of Net Better Off, financial stability is under the greatest pressure right now. Pre-COVID, almost all banks were reducing headcount, and this has accelerated. Notably, 41 percent of the banking workforce are worried about job stability.

Almost all banks are reducing headcount: digital channels and ways of working highlight ways to automate some work, especially as cost pressures bite. What’s surprising is how often banks reduce headcount as a knee-jerk reaction, rather than using turnover to reduce headcount over time and creatively redeploy and up- or reskill people into areas of high demand.

What to ask today to be better off tomorrow:

- How do we support those with reduced work or facing unemployment?

- Do our reward and benefit packages meet the evolving needs of our people, both in times of crisis and in times of abundance?

- How do we reduce headcount in a way that allows us to be fiscally responsible and care for all individuals?

Employability

Finally, people can achieve their full potential if they have marketable, in-demand capabilities and skills that make it easy to obtain good jobs and advance in a career. Just as purpose is no longer a nice-to-have, you need to approach new skilling and restructuring with integrity—and 76 percent of banking workers expect employers to be accountable here.

For example, our Workforce 2025 research found that financial institutions can unlock up to $140 billion in industry value through a combination of cost savings through automation (up to $23 billion) and productivity gains through augmentation (up to $117 billion). Achieving these gains depends on having a future-ready workforce that’s equipped with the skills and mindset for creativity and innovation.

In addition, the “one role, one worker” approach will give way to more fluid, task-based and skills-based ways of approaching work. Digital talent marketplaces, job sharing and pooling talent with ecosystem partners will become the norm. Secondments, cross-training and digital fluency will become increasingly important tools for ensuring that people have the sufficient depth and breadth of skills needed to be successful.

Finally, technology is a key piece of upskilling and reskilling people at scale. That’s why Accenture works with SkyHive to support agile, responsive workforce strategies that focus on skills, not roles. SkyHive uses machine learning and deep learning to analyze employees, workforces and labor markets in real time. That means we can help clients understand and adapt to the changing needs of their workforce, identify skills gaps and connect learners with appropriate training, and quickly acquire or transition talent.

Making people Net Better Off may be easier during the good times—and it’s even more important during the challenging times.

The pandemic may have forced your company to cut costs and restructure; even before that, digital transformation probably made you think about how you’d reskill the people whose jobs were displaced by automation. And our digital fluency research uncovered that for 62 percent of banking workers, remote work has made them consider the need to re- or up-skill themselves, with cloud computing, cyber security and digital collaboration skills in hot demand.

As a society, our ability to reskill people is a critical piece in making sure that human ingenuity keeps pace with technological change.

What to ask today to be better off tomorrow:

- Are we equipping people with the skills they need to be ready for new roles and emerging industries?

- Are we approaching cost-cutting, furloughs and automation with an equal eye to reskilling and finding meaningful work for the people whose jobs will be affected?

Why banks need to think about the future of work

There’s no question that 2020 was a challenging year. Now, there is hope on the horizon. For example, here in the UK, more than 130,000 people received the COVID-19 vaccine in the first week of the program.

In addition, most companies and individuals have adapted to remote work. Most banks are seeing some degree of improvement to productivity and performance, and many are planning for some form of hybrid workforce that combines remote and in-person working, virtual and physical office spaces.

You may love working from home, feel more productive and enjoy the flexibility. Or you may struggle with it, feel cooped up and find it hard to draw boundaries between work and life. When I talk to clients, many are pleased with how well their people have adjusted to remote work, but the benefits aren’t uniform. Many are asking questions about the sustainability of people’s productivity and performance.

For example, 62 percent of the banking workforce says that remote work allows them to be as effective as they are face to face. And prior to COVID-19, 18 percent of the banking workforce worked remotely. That’s now 80 percent, which demonstrates the resilience and responsiveness of the industry and the people within it. But there’s a caveat. When asked about the optimal amount of time people would like to work from home, the mean response was 43 percent—about half of what it is now.

Which is to say, the pandemic has highlighted opportunities to create change for good. And indeed, many financial institutions are doing NBO well: 61 percent of banking workers said their employers are leading in most or all of the NBO dimensions, 35 percent said their employer’s response was average and just 4 percent said their company’s response was poor.

As we look to the year ahead, remember this: Out of crisis comes opportunity. We have an opportunity to make work more flexible, more agile—and more human. Your organization can have greater accountability for leaving your people Net Better Off. It’s a newfound responsibility that can enable us to build a better future post-pandemic, rather than return to what we had before.

Let’s keep it up. By focusing on helping people achieve Net Better Off, we can build a better future.

Why it pays to leave people Net Better Off

The question is, how do we design and create the future of work that unleashes people’s potential?

This is how: by making people Net Better Off, and by focusing on the six components of high human care. Importantly, these six components are interrelated and need to be congruent with each other.

That is, you can’t address physical health without considering mental health or relational wellbeing. You can’t view employability and financial wellness separately. And you can’t address one part of it and expect everything else to fall into place.

In other words, you need to think holistically. Your people consider all of these factors, together, when they ask: Are you supporting me? Are you leaving me Net Better Off?

Well, are you?

To learn more about how to leave your people Net Better Off, contact me here or on Twitter at @andyyoungACN.

Many thanks to Ellyn Shook, David Rodriguez, Ph.D. and Eva Sage-Gavin for your leadership in this area.