Fed courts nonbanks for FedNow growth

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

South State Correspondent

APRIL 22, 2024

In a few short months, stronger economic data (higher GDP, stronger job market, and stubborn inflation) changed the market’s and the Fed’s view on the future path of interest rates. The market and the Fed are now aligning on only one rate cut in 2024 – obviously this will change over the course of the year as the economic data evolves. The market, and most economists, often get interest rate predictions wrong.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BankBazaar

APRIL 23, 2024

Let’s face it, talking about money isn’t always sunshine and rainbows. We all dream of financial freedom, but the road there can be paved with some pretty epic stumbles. From the infamous “bottomless cocktail brunch” every Sunday that mysteriously drained your savings account to the “surely-I’ll-win-the-lottery” mentality, personal finance fails are a universal experience.

Jack Henry

APRIL 22, 2024

The Magic 8 Ball might be the easiest fortune-telling device available. You simply ask it a question, shake it, then read its response through the little window.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

APRIL 23, 2024

The processing and payments technology giant is increasingly selling its services abroad, but also benefiting lately from sales to government entities at home.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

APRIL 23, 2024

Goldman Sachs Group Inc. is closing down its automated-investing business for the masses after clinching a deal with Betterment. The bank has struck an agreement to transfer clients and their assets from the unit known as Marcus Invest to Betterment, a $45 billion digital investment-advisory firm.

The Paypers

APRIL 22, 2024

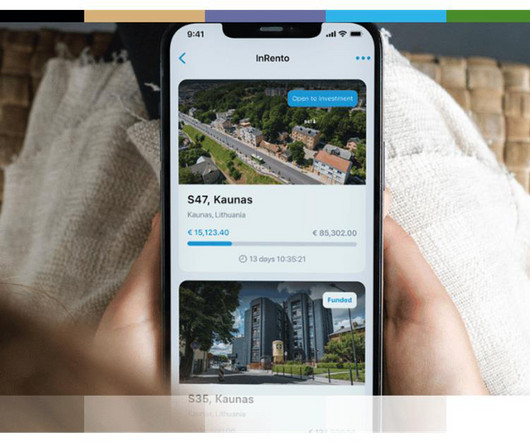

Lithuania-based fintech Paysera has incorporated in its app the ability to directly invest in crowdfunded real estate rental projects on the InRento platform.

Payments Dive

APRIL 23, 2024

After successfully raising $150 million in funding, the finance automation platform will have its choice of acquisition targets, according to research firm CB Insights.

American Banker

APRIL 22, 2024

The bank will use biometric authentication to streamline checkout in stores starting in 2025. It has already completed internal and external pilots of the technology.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

APRIL 22, 2024

Truist Bank expects to continue investing in technology to save money as it restructures. “We continue to see improvements in productivity due to investments in technology,” Chief Executive William Rogers said today during Truist’s first-quarter earnings call.

TheGuardian

APRIL 22, 2024

The Jubilee 2000 saw $130bn of debt written off, and yet we now find ourselves in a renewed global debt crisis, says Maria Finnerty of Cafod The Guardian is right to identify the global sovereign debt crisis as one of the most critical impediments to sustainable development today ( Editorial,16 April ). Debt relief is urgently needed, but we must also learn the lessons of history.

Payments Dive

APRIL 22, 2024

The CFPB report put gaming companies on notice that the long-expected regulatory scrutiny has arrived, according to professionals involved in the industry.

American Banker

APRIL 22, 2024

With financial crime surging worldwide, it is critical that the public and private sectors align on a shared vision to collectively focus on combating bad actors and to eliminate their ability to launder the proceeds of criminal activity.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

BankInovation

APRIL 23, 2024

Financial services technology provider Fiserv is deploying AI to drive productivity and sees growth opportunities in the point-of-sale and real-time payments segments.

ATM Marketplace

APRIL 23, 2024

The Bank Customer Experience Summit 2024's first early bird deadline is coming up on May 3rd.

Payments Dive

APRIL 22, 2024

JPMorgan Chase is an early user of Codat’s Supplier Enablement product, which launched this week.

American Banker

APRIL 22, 2024

Banks reported nearly $27 billion had been tied up in scams or theft against elderly people in a recent 12-month period, according to a report from the U.S. Treasury.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

BankInovation

APRIL 23, 2024

Uplinq, a credit decisioning support platform for small business lenders, named former Wells Fargo leader Derek Ellington as its strategic adviser.

The Paypers

APRIL 23, 2024

UAE-based du has announced the launch of du Pay to boost UAE’s transition toward a cashless economy and support the national digitalisation agenda.

Bussman Advisory

APRIL 20, 2024

The latest edition of the FinTech Ecosystem Newsletter is here: Image Credits: shutterstock.com The post Microsoft invests $1.5 billion in AI firm G42 | Software giant Salesforce in advanced talks to buy Informatica | Revolut valuation raised 45% by investor appeared first on Bussmann Advisory AG.

American Banker

APRIL 22, 2024

After several quarters of slumping investment banking and trading fees, the Charlotte, North Carolina-based company reported a big uptick from that division, which helped compensate for a large decline in net interest income.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

TheGuardian

APRIL 23, 2024

Bank of England executive says creeping sense of complacency and lack of data is putting lenders at risk UK banks are leaving themselves open to “severe, unexpected losses”, by failing to properly measure how exposed they are to the $8tn private equity industry, the Bank of England has warned. In a speech on Tuesday, Rebecca Jackson, a senior executive at the central bank, said there was a “creeping sense of complacency” among lenders, who – despite a boom in loans and financing to the sector –

The Paypers

APRIL 23, 2024

US-based payments provider Nium has partnered with Indonesia-based payment infrastructure company Artajasa to augment cross-border transfers for Indonesians.

The Financial Brand

APRIL 22, 2024

This article Why Banks Risk Data Chaos by Rushing Into AI for CRM appeared first on The Financial Brand. Poorly trained AI-driven CRM could lead to unchecked inaccuracies due to hallucinations, leaks of sensitive customer data, and create unintended discriminatory behavior. This article Why Banks Risk Data Chaos by Rushing Into AI for CRM appeared first on The Financial Brand.

American Banker

APRIL 23, 2024

In a letter to Treasury Secretary Janet Yellen last week, the Massachusetts senator highlighted the growing use of cryptocurrencies by malicious organizations abroad and underscored the need for anti-money-laundering and counterterrorism provisions in future proposals.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

Let's personalize your content