Fed courts nonbanks for FedNow growth

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

Perficient

APRIL 24, 2024

Uncovering the Challenge: Relying on Spreadsheets for Portfolio Analysis A leading wealth and asset management firm recently sought our financial services expertise for a critical challenge. Relying on complex spreadsheets for portfolio analysis, the firm faced operational hurdles due to immense computing demands. The Perficient Approach: Transforming Operations through Strategic Consulting Our team embraced the challenge, conducting a meticulous two-week analysis to uncover the root issue: a cu

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

APRIL 22, 2024

In a few short months, stronger economic data (higher GDP, stronger job market, and stubborn inflation) changed the market’s and the Fed’s view on the future path of interest rates. The market and the Fed are now aligning on only one rate cut in 2024 – obviously this will change over the course of the year as the economic data evolves. The market, and most economists, often get interest rate predictions wrong.

Jack Henry

APRIL 22, 2024

The Magic 8 Ball might be the easiest fortune-telling device available. You simply ask it a question, shake it, then read its response through the little window.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

APRIL 24, 2024

The card network behemoth’s latest earnings report showed a contraction in card volume growth during the first three months of the year, and into April.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

APRIL 21, 2024

As recently as a few months ago, many observers predicted a surge of bank mergers this year. But longtime obstacles to dealmaking are still there and have been joined by new ones.

TheGuardian

APRIL 23, 2024

Bank of England executive says creeping sense of complacency and lack of data is putting lenders at risk UK banks are leaving themselves open to “severe, unexpected losses”, by failing to properly measure how exposed they are to the $8tn private equity industry, the Bank of England has warned. In a speech on Tuesday, Rebecca Jackson, a senior executive at the central bank, said there was a “creeping sense of complacency” among lenders, who – despite a boom in loans and financing to the sector –

Payments Dive

APRIL 23, 2024

The processing and payments technology giant is increasingly selling its services abroad, but also benefiting lately from sales to government entities at home.

BankInovation

APRIL 22, 2024

Truist Bank expects to continue investing in technology to save money as it restructures. “We continue to see improvements in productivity due to investments in technology,” Chief Executive William Rogers said today during Truist’s first-quarter earnings call.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

APRIL 23, 2024

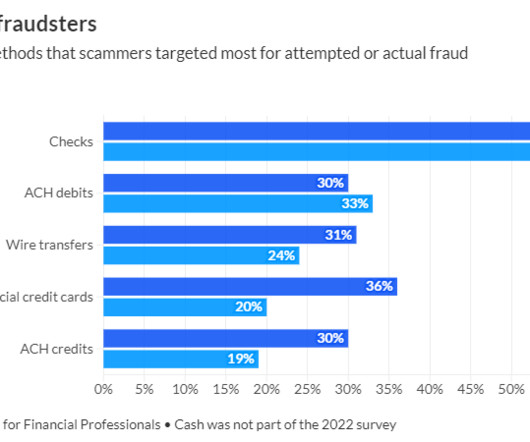

A new Citizens Bank survey suggests rising check-fraud incidents are driving middle-market companies to accelerate plans to fully adopt digital payments. But 70% of all businesses will continue to rely on checks for years to come, according to recent data from the Association for Financial Professionals.

BankUnderground

APRIL 24, 2024

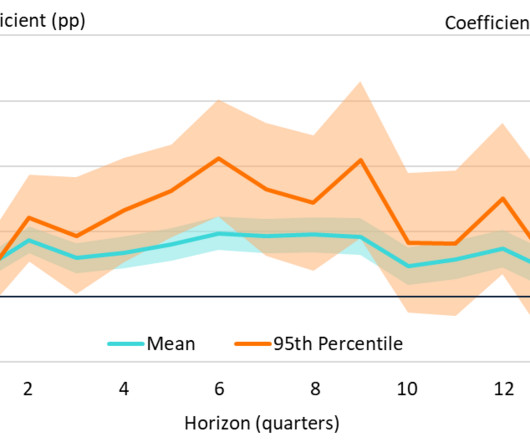

Julian Reynolds Policymakers and market participants consistently cite geopolitical developments as a key risk to the global economy and financial system. But how can one quantify the potential macroeconomic effects of these developments? Applying local projections to a popular metric of geopolitical risk, I show that geopolitical risk weighs on GDP in the central case and increases the severity of adverse outcomes.

Payments Dive

APRIL 24, 2024

The fintech One now offers buy now, pay later financing at the store chain, presenting competition for Affirm, which has partnered with the retail giant since 2019.

BankInovation

APRIL 23, 2024

Goldman Sachs Group Inc. is closing down its automated-investing business for the masses after clinching a deal with Betterment. The bank has struck an agreement to transfer clients and their assets from the unit known as Marcus Invest to Betterment, a $45 billion digital investment-advisory firm.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

American Banker

APRIL 22, 2024

The bank will use biometric authentication to streamline checkout in stores starting in 2025. It has already completed internal and external pilots of the technology.

The Paypers

APRIL 23, 2024

UAE-based du has announced the launch of du Pay to boost UAE’s transition toward a cashless economy and support the national digitalisation agenda.

Payments Dive

APRIL 23, 2024

After successfully raising $150 million in funding, the finance automation platform will have its choice of acquisition targets, according to research firm CB Insights.

BankInovation

APRIL 23, 2024

Financial services technology provider Fiserv is deploying AI to drive productivity and sees growth opportunities in the point-of-sale and real-time payments segments.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

APRIL 22, 2024

With financial crime surging worldwide, it is critical that the public and private sectors align on a shared vision to collectively focus on combating bad actors and to eliminate their ability to launder the proceeds of criminal activity.

The Paypers

APRIL 22, 2024

Lithuania-based fintech Paysera has incorporated in its app the ability to directly invest in crowdfunded real estate rental projects on the InRento platform.

Payments Dive

APRIL 22, 2024

The CFPB report put gaming companies on notice that the long-expected regulatory scrutiny has arrived, according to professionals involved in the industry.

BankInovation

APRIL 24, 2024

Bank of America’s innovation is never complete since its team constantly updates offerings to meet ever-changing client needs. “At Bank of America, innovation is everybody’s job,” Jorge Camargo, managing director of mobile app, online banking and Erica AI at Bank of America, told Bank Automation News.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

APRIL 22, 2024

Banks reported nearly $27 billion had been tied up in scams or theft against elderly people in a recent 12-month period, according to a report from the U.S. Treasury.

ABA Community Banking

APRIL 24, 2024

The FDIC named four new bankers as members of the agency's Minority Depository Institutions Subcommittee. The post FDIC names four bankers to MDI subcommittee appeared first on ABA Banking Journal.

Payments Dive

APRIL 23, 2024

The Swedish BNPL pioneer said it has formed new partnerships with the ride-share company, as well as the travel firm Expedia Group.

BankInovation

APRIL 23, 2024

Uplinq, a credit decisioning support platform for small business lenders, named former Wells Fargo leader Derek Ellington as its strategic adviser.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

Let's personalize your content