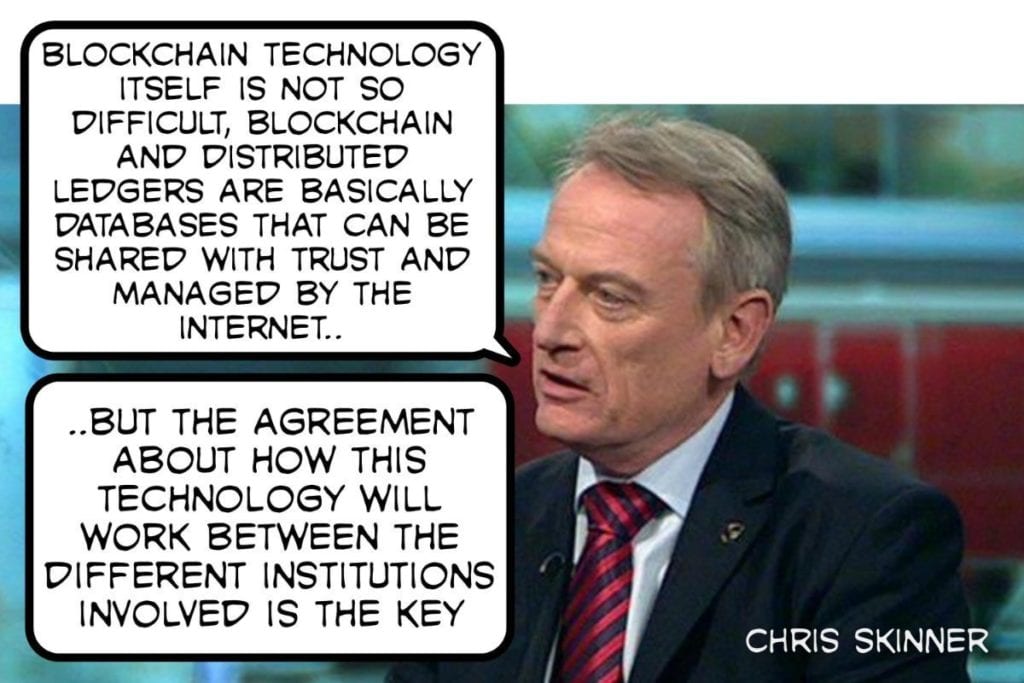

There has been a lot of thinking and rethinking during 2018 about blockchain, cryptocurrencies, bitcoin and everything digital currency related. I wrote about the challenges getting blockchains implemented for example, and was surprised to find myself enduing up as a network meme.

The power of the pundit, ay?

Last year we saw bitcoin drop from a valuation of near $20,000 to a hovering just above $3,000 a year later, and many levels in-between. This is not a stable market and anyone who believes cryptocurrencies, blockchains and ICOs and the rest of truly investable are a little deluded. Right now, they’re about as safe as a night in Las Vegas. However, there are investable assets in crypto if you know were to look. I just feel sorry for the vast number of idiots who didn’t have their eyes open.

Anyways, my friends at 11FS and specifically Simon Taylor, who hosts the Blockchain Insiders, has made some interesting predictions for 2019.

Prediction 1: The crypto part of “crypto” becomes much more important than the asset or currency part

Continuing the trend from last year, Simon predicts that we’ll see fewer headlines about “using blockchain” and much more of people happening to use privacy preserving crypto. Projects that use crypto to get multiple parties to agree a state is still true.

Vitalik Buterin, creator of Ethereum, made this point on Blockchain Insider Episode 76:

“You could sign a transaction or message before blockchain, but you couldn’t prove it was still true as of right now”

Crypto networks prove data is valid, that many parties agree it’s the same and that it’s still valid right now. Else, there would be a new transaction appended. This is huge for all kinds of industries and software and when the mainstream understands that, the game changes. Whether that needs a currency or not doesn’t matter.

Prediction 2: Distributed Ledger Technology (DLT) makes a comeback

DLT never really went away, it just got a lot less airtime because it wasn’t a mainstream phenomenon that every taxi driver and person in the pub was talking about. Quietly, many of those POC’s have been progressing. Corporates move in 7-year increments, and if you check your flux capacitor, it’s soon to be 4 years since 2015 and the year of DLT mega-hype. Where we’re going, we don’t need coins.

Back to the future references aside, DLT is starting to get really real. It’s in production, and volume is coming. Whether that’s in syndicated loans, trade finance or cross-border payments. This stuff is getting real.

What really excites is where FX meets central banks. This could really happen people, and nobody is watching. “Smart team works hard and eventually gets there” doesn’t make a great headline but that is the news.

Prediction 3: Institutions dip a toe in the water as infrastructure build-out hardens

So there are a few narratives out there about “Bitcoin being the new sound money” or “the institutions are coming” as the reasons why crypto makes a come back in 2019. But if you look at the 2018 price predictions for these people they’re frankly bonkers.

The amount of attention being paid by big banks to crypto is massively overblown. Yes, they evaluated and continue to watch the space, but the reality is it’s incredibly small compared to global markets. If they moved in they’d move the market with one trade.

Instead, you will see much smaller specialists buy side firms professionalise crypto and start to even out some of the volatility, and long-term that’s a very good thing.

Prediction 4: Regulatory clarity comes at last

Regulators gonna regulate. If 2018 saw the beginning of ICO’s being fined and their proprietors being arrested, then it also saw a very clear line in the sand from regulators and policymakers. Governments find themselves in a challenging position. Many see huge value in crypto networks to make markets more efficient, transparent and fair but they’re wrestling with a real increase in criminal activity using crypto assets on the dark web.

It’s no longer the case that “doing KYC” is enough. If you’re going to raise $20m, you should expect that people would ask questions like where is the money coming from and what do they get in return. What we’re seeing in the death of the ICO is not entirely surprising through that lens.

The real concern is that we might have thrown the baby out with the bath water. If we replace ICO’s with securities offerings, where the process is in paper and looks exactly like it does today, but with tokens instead of share certificates. What did we achieve?

Prediction 5: New projects are born that go on to be household names in the next decade

This one is Simon’s wildcard, but why not. It’s when markets are down amazing things happen. What happens next is really anyone’s guess.

And yes, the future ain’t what it used to be Simon.

Anyways, if you like these predictions and prefer an audible version of all things blockchain, I suggest you listen to the crypto predictions on Blockchain Insiders https://bi.11fs.com/80. The guys start by reviewing their 2018 predictions – this episode was recorded in December 2018 – and then make their forecasts for 2019 from 22 minutes onwards. Well worth a download.

Meantime, for a bit of balance, I also received a nice email from Paul Veradittakit, a Partner at Pantera Capital who are one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. His predictions for 2019 are as follows:

Consolidation - This year we’ve already seen two of the largest acquisitions in the space with Bitstamp getting acquired by NXMH and Chain getting acquired by Stellar in addition to others like Earn and Paradex. Coinbase hired Emilie Choi to head up BD and corporate development and other established crypto companies are looking at both investing into early stage startups or acquiring. Traditional tech startups are even spending more resources on figuring out their blockchain strategy, as Facebook has hired more employees for its blockchain team and is rumoured to be developing a stablecoin for payments in Whatsapp. In 2019, I (Paul Veradittakit) see a ramp-up in acquisitions by established players like Coinbase, Circle, and Bitmain but also a major significant acquisition by a traditional tech giant.

STOs - Security tokens have been one of the hottest topics of the year. With regulations becoming more of a focus, projects are treating their tokens as if they are securities. As infrastructure is being built for institutions to speculate on non-security tokens, there is a belief that they are more likely to speculate on security tokens, asset-backed tokens that could represent ownership/profits in art, REITs, funds, etc. Recently, Harbor, launched the first institutional-grade security token offering by offering an investment opportunity into a student housing real-estate property owned by DRW. In 2019, I think that STOs (security-token offerings) will gain traction through issuance platforms but will fail to meet expectations in becoming a largely traded asset class as it will take some time for this sector to take off due to education, regulation, and infrastructure.

Death of ICOs - Over $20B has been raised using initial coin offerings in the past 2 years, and we are likely to see a high-percentage of them fail due to not being able to execute because of regulations and/or operational capital. The latter reason could be attributed to the project not actually needing a token, mismanagement of treasury, or just not being able to achieve product-market fit. Recently, we’ve seen Basis shutdown due to regulatory hurdles. In 2019, I think that a lot of the ICOs that came to market early or in early 2018 will shut down and some of those will be very high-profile.

Institutional Capital - This year we’ve seen some pretty sizable and high profile funding rounds for infrastructure that will help onboard institutional investors into the space. On the custodian side, Bakkt, Anchor, and Bitgo have raised rounds. On the trading execution side, Omniex, Tagomi, and Lumina have raised rounds. In 2019, while the infrastructure is being built, it will take some more time for institutions to get comfortable around risk and regulations and therefore 2019 won’t be the year that they come in a big way.

Scalability - This year, we’ve seen a ton of projects focused on scalability and most of the capital into tokens this year by Pantera has been surrounding projects tackling this. Coda, Algorand, Dfinity, Thunder, Oasis, etc have raised significant rounds on the Layer 1 side. Celer, Lightning, and Bloxroute have raised significant rounds on the Layer 2 side. In 2019, I believe we’ll see launches of most of these scalability projects and at least one of them to get gain solid traction to compete as a next-level platform for smart contracts.

OK guys, that’s almost it for my 2019 scene setting although, just to add one last touch to the mix, tomorrow, I give my view.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...