Eight major U.S. banks are halting near-term plans to buy back their own shares in the midst of the coronavirus pandemic, and investors will be watching closely to see if regional banks do the same.

So far, U.S. Bancorp in Minneapolis, PNC Financial Services Group in Pittsburgh, Comerica Bank in Dallas and Regions Financial in Birmingham, Ala., have suspended share buybacks in the near-term. Like the eight global banks, the three declared they will halt their repurchase programs in response to the COVID-19 crisis at least until the end of the second quarter.

Large banks had been under some pressure from policymakers to halt buybacks to free up capital for lending, but there is no such pressure on smaller regionals to follow suit.

Still, Brian Klock, an analyst at Keefe, Bruyette & Woods, said that the larger regional banks “might be advised by their regulators to hold off. There could be a lot of unofficial pausing of buybacks across the industry until banks see how severe this is going to be for their customers.”

U.S. Bancorp and PNC are two of the nation’s largest regional banks, with $486 billion of assets and $398 billion of assets respectively. Regions is a top-25 bank, with $126 billion of assets. Comerica is the smallest of the group, with assets of $73 billion.

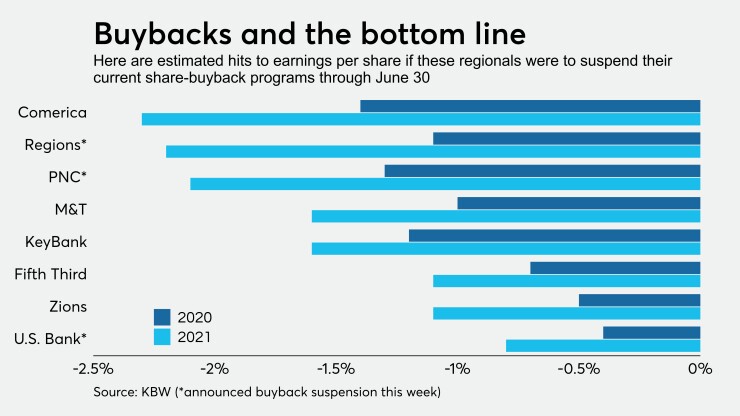

Even as some banks do hit the pause button on share repurchase plans, the overall hit to earnings per share should be fairly small compared to that of larger banks. According to new research conducted by KBW, the estimated median EPS decline among those eight banks is estimated to be 3% in 2021.

Meanwhile, the hit on EPS at large regional banks is estimated to be a 1.1% decline next year.

Read more:

In the midst of growing economic turmoil across the globe and

The move came on the same day

Late Sunday, U.S. Bancorp said it too would halt buybacks in order to “support the efforts that the Federal Reserve is taking to moderate the impact of COVID-19 on the economy and global markets by maintaining strong capital levels and liquidity to support customers, employees and shareholders.”

Regions’ announcement came late Monday afternoon. In a statement, the bank said it "is committed to maintaining strong capital and liquidity to meet the needs of its customers and communities during this exceptional period of economic uncertainty. The suspension of share buybacks will not impact dividend payments to shareholders and Regions has the ability to reinstate the buyback program as circumstances warrant. Regions is subject to the Federal Reserve’s annual stress test and has consistently demonstrated the capability to support lending and other necessary financial services during a significant economic downturn.”

Last week, a top executive at Synovus Financial said the Columbus, Ga.-based bank expected to continue buying back shares throughout the year. According to President and Chief Operating Officer Kevin Blair, last year the bank purchased $725 million of its own stock and this year the board authorized up to $200 million in buybacks.

On Monday, the bank sounded less certain of that plan.

“As we continue to monitor the severity and duration of the pandemic, we will weigh the benefits of share repurchases versus preserving and utilizing capital to support customers,” Blair said in an email.

Bank stocks tanked again on Monday, with shares of most banks falling by double digits. The KBW Nasdaq Bank Index, an index of large and regional bank stocks was down, another 16.2%, to 62.47. Janney Montgomery Scott analyts Christopher Marinac, director of equity research, and Brian Martin, who covers banks and thrifts, said the drop-off was due to the Fed’s rates cut, not the halts in buybacks.

They emphasized that banks overall are well-capitalized and stronger than they were during the financial crisis of 2008. They said banks are “absolutely lending money and taking deposits” and there’s no sense at the current time that dividend payments to shareholders are at risk of being reduced.

“I still think this is a temporary dislocation,” Marinac said. “The challenge is, is it a 90-day dislocation or six weeks? It’s probably somewhere in between.”