Much like the internet was once considered a fad, the same was said not so long ago about social media. Earlier this year, Facebook reported more than 1.35 billion active users logging on monthly. That’s roughly 20 percent of the world population. Take a second to allow that to sink in; it is an incredible statistic. The social network truly connects people.

As the other prominent social media platform, Twitter sees more than 284 million active monthly users and 500 million tweets per day (fun fact: the company also consumes more than 1,400 hard-boiled eggs per week, too). That’s slightly more active users than there are people in Indonesia, the world’s fourth most populous country (behind China, India and the United States). Another staggering figure.

Clearly, those in the “social media is a fad” camp were mistaken.

Online platforms like Facebook and Twitter allow people to connect with one another as well as with brands. As a bank or credit union – and a unique brand reaching customers every day – is your institution active on social media? Should connecting with your borrowers and clients be limited just to checking a branch’s hours or an available balance? Customer service in banking is increasingly determined by a digital presence.

The Financial Brand recently released their results from a five-year long study of the social media presence within the banking field, with some interesting insights about which banks and credit unions are making an impact online.

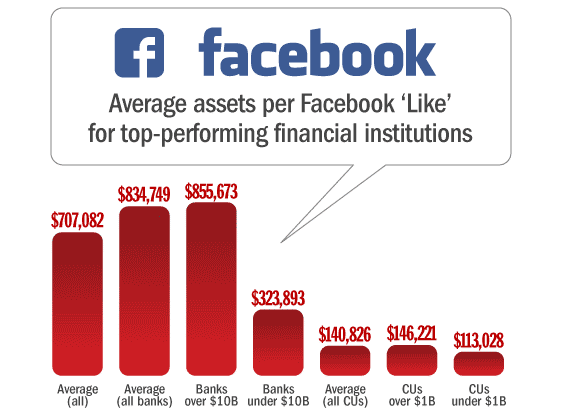

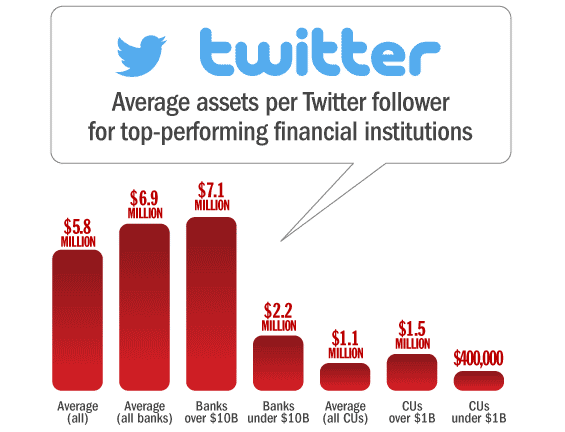

The site analyzed the social media community built by the top banks and credit unions alongside the institution’s asset size. The Financial Brand found that for every one “like” on Facebook equated to about $700,000 in assets, and $5.8 million in assets for every one follower on Twitter. When comparing social impact of banks versus credit unions, the results showed that CUs tend to have an easier time building a community. A credit union has a lower ratio of average assets-per-Like on Facebook by six times that of a bank -- $140,826 for credit unions $834,749 among banks. On Twitter, credit unions score an average of $1.1 million in assets per follower; an average of all banks on Twitter is around $6.9 million.

Which banks and credit unions are doing social media well? It’s probably no surprise that the biggest banks in the United States – those most likely to have a department dedicated to social media content and marketing – attract the largest numbers on Facebook. Capital One, Chase, Bank of America and Citi are the top four, each with more than one million Likes (it’s also worth noting that they are the only four banks to reach that threshold). Notably, only one credit union surpasses the one million mark – Navy. America First and Mountain America follow with just more than 130,000 Likes each.

Navy also takes the top spot on Twitter with about 66,000 followers – reaching more people than the other nine of the top 10 on the list. Top banks fared much better on Twitter with Citi’s 347,000 followers – about five times as many as Navy. Again, Bank of America and Capital One landed in the top five, along with Goldman Sachs and Wells Fargo – all of whom reach more than 100,000 followers.

If yours is one of the thousands of banks or credit unions that didn’t land on the best of social media lists – not to mention probably lacking a social media department, let alone a dedicated staffer – don’t fret. One of the universal keys to mastering social media is engagement. If your institution is on Facebook or Twitter (or any other social platform), use it. Social media presence is a valuable tool for engaging with customers. If your institution uses the platforms sporadically, or if you would just like to do social better, here are a few easy tips for increasing engagement:

• Engage with your customers on whatever level makes the most sense for your bank or credit union. It doesn't have to be a “go big or go home” play – if it only makes sense to share your institution’s news, then do that. But keep in mind #2…

• Post consistently. This doesn't have to mean once an hour. Even once a day can make an impact if you’re offering valuable information.

• Share information that you would want to see as a customer. If the lobby of your institution will be remodeled and clients will need to enter through another door, this is valuable information to pass along (particularly if this isn't something you’d want to announce on your website). News articles relevant to your social audience is another way to engage. Consider sharing an article about best practices for paying down credit card debt, or ways to save money during the holiday season.