Two Michigan banks have revived an M&A deal that looked like it had been doomed by the pandemic recession.

Ann Arbor Bancorp on Monday said it has agreed — again — to buy the $647 million-asset FNBH Bancorp in Howell.

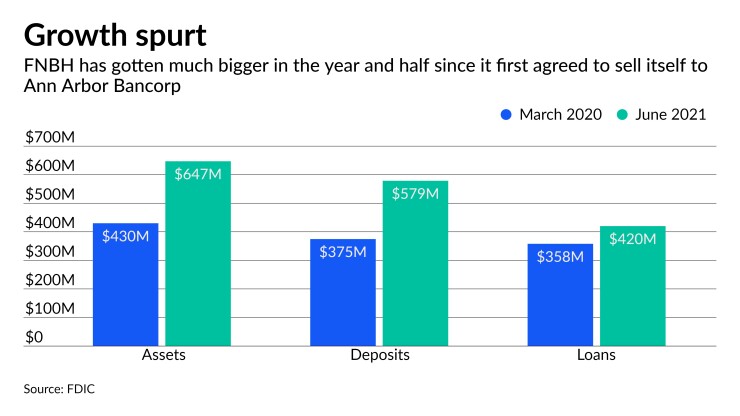

In the latest agreement, Ann Arbor would pay $116.5 million in cash for FNBH, which has grown significantly in the past year thanks in large part to its participation in the Paycheck Protection Program. FNBH made more than $103 million of PPP loans in 2020 and 2021. FNBH’s equity capital, which totaled $53.9 million on March 31, 2020, had grown to $62.4 million at the end of the second quarter, according to the Federal Deposit Insurance Corp.

“Both banks are stronger today than they were at the start of the pandemic,” FNBH President and CEO Ron Long said Monday.

Acquiring FNBH would give Ann Arbor Bancorp, parent to the $2.56 billion-asset Bank of Ann Arbor, its first presence in Livingston County. Howell, the county seat, is 50 miles northwest of Detroit. FNBH holds about 13% of the $3.5 billion of deposits in the Livingston market, according to the FDIC.

President and CEO Tim Marshall said gaining a foothold in Livingston County, one of Michigan’s fastest-growing areas, has long been a strategic goal for Ann Arbor.

“Our board has talked about Livingston County for years,” Marshall said Monday. “We looked at possible [de novo] locations and never could really find the right place or the right people.”

According to Marshall, the companies kept in touch after the first deal was terminated, holding a quarterly conference call involving board members and management “to see how everything was going with each other’s banks.”

“I would say our last call, which was in early May, prompted all of us … to start up 2.0,” Marshall said.

Monday’s deal is expected to close by year-end. The merged company would have more than $3 billion of assets and 17 branches in four Michigan counties: Wayne, Oakland, Washtenaw and Livingston.

Long has agreed to serve as the merged company’s district president for Livingston County. Stan Dickson, FNBH’s largest shareholder, would join Ann Arbor Bancorp’s board. Long’s decision to stay on would give Ann Arbor a crucial boost once the deal closes, Marshall said.

“The importance of him getting up out of bed and going to the coffee shop in the morning, being able to take the temperature of the community … will pay long-term dividends to us,” Marshall said. “We want a market leader with feet on the ground, going to community events, talking to customers and making sure we’re doing all the right things.”

After FNBH lost more than $40 million between 2007 and 2011, Dickson helped

“Both organizations share common values and the passion to provide attentive customer service, and the combination will only enhance these principles,” Dickson said in the press release announcing the deal.

Ann Arbor’s most recent acquisition was its