Susan Riel endured a number of shocks in 2019 that will carry over into the new year.

Riel, who

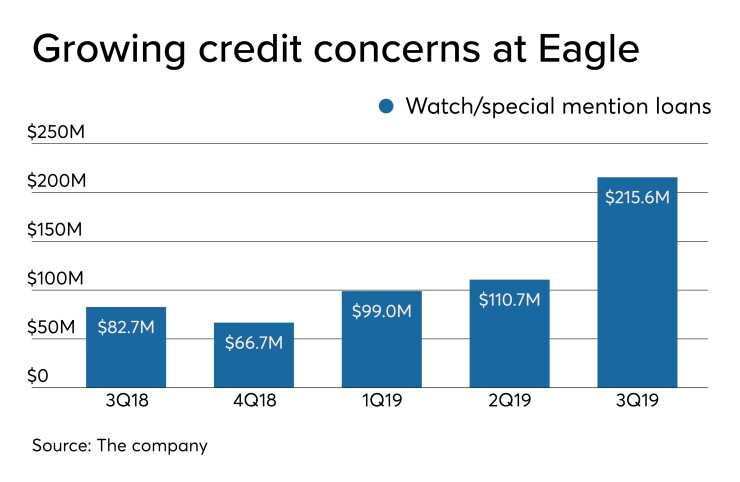

Eagle disclosed this fall that its watch and special mention loans

The $9 billion-asset company continues to inch closer to a key threshold that will usher in added regulatory scrutiny, along with a cap on interchange fees. A bank acquisition could help Eagle offset lower revenue and higher costs tied to surpassing $10 billion in assets.

For these reasons, Riel is one of American Banker's five community bank CEOs to watch in 2020.

Eagle is capable of dealing with lingering issues, Riel insists.

The Evans matter “has had minimal impact on our customers and their relationships with EagleBank,” Riel said in an interview. “We have a great team of attorneys working on these types of issues, so the time spent on investigations and legal matters by bank staff is very limited.”

That may be so, but the situation clearly spooked investors. Riel’s disclosure on July 17 triggered a sell-off in Eagle shares, which plummeted 27% that day. While the stock has recovered some, it still remains down by about 9% from when the disclosure was made.

A week after the selloff, activist investor Shiva Stein filed a lawsuit against Eagle, arguing that weak internal controls made heightened legal and regulatory scrutiny foreseeable. The case is still active. In its latest quarterly filing with the Securities and Exchange Commission, Eagle said it “believes that the claims asserted are without merit and intends to defend vigorously against them.”

Credit quality, meanwhile, has long been one of Eagle’s hallmarks. Nonperforming loans made up 0.76% of total loans on Sept. 30. While better than the commercial bank average of 0.87%, it was a significant jump from the 0.21% reported a year earlier.

Eagle's loan-loss allowance was equal to 0.98% of loans on Sept. 30, compared with 1.2% for all banks.

Riel called the nearly $74 million Eagle has set aside for credit risk adequate, adding that “management continues to remain attentive to any signs of deterioration in borrowers’ financial conditions.”

Riel has been doing more than putting out fires since replacing Paul, who stepped down abruptly, citing health issues.

Eagle has expanded into the lucrative Prince George’s County, Md., market; resumed paying dividends after an 11-year break; restructured its board; and initiated its first-ever share repurchase plan.

One strategy that hasn't changed is Eagle’s focus on commercial real estate lending, which has served as its growth engine since Paul founded the company in mid-1998. CRE made up nearly two-thirds of Eagle’s $7.6 billion loan book on Sept. 30. For the industry as a whole, CRE makes up less than a quarter of loans, according to the Federal Deposit Insurance Corp.

Riel said she views CRE as a “core competency” at Eagle.

“We have stated that a potential for late-cycle risk will have us being more selective about how we approach construction lending, but we're certainly still in the business of lending on commercial real estate,” Riel said.

A reluctance to rock the boat too much shouldn’t come as a surprise. Before becoming CEO, Riel was the bank's chief operating officer, where she had a major influence on the business model.

“I was Mr. Paul’s only report,” Riel said. “The rest of the bank reported up to me.”

As CEO, Riel has kept Eagle on an even keel despite ongoing investigations and concerns about credit quality. Net income for the first nine months of 2019 fell 4% from a year earlier, to $107.5 million.

Higher legal, professional and accounting fees have been a problem for Eagle since late 2017 when

There are reasons for optimism. Eagle reported in its most recent SEC quarterly filing that a $16.5 million loan that had been on nonaccrual status recently became current. Excluding it, nonaccrual loans would have totaled 0.47% of total loans.

It could be a while — possibly 2022 — before Eagle organically hits $10 billion in assets, said Chris Marinac, an analyst at Janney Montgomery Scott.

Marinac expressed confidence that Eagle will regain its footing next year. He said the company can offset higher loan-loss provisions with solid mortgage banking revenue, loan growth and lower funding costs. Overall, Marinac is predicting a 3% increase in earnings per share next year, and a 7% increase in 2021.

As for acquisitions, Eagle will take an “opportunistic approach to M&A," Riel said, though it would likely keep its focus on the Washington area.

“We’re committed to the D.C. metropolitan area,” Riel said. “Management feels that there continues to be great opportunities, given that we hold only about 3.2% of the deposit market.”

For now, Eagle "continues to pour resources into our information technology infrastructure,” she said.