When it comes to paying bills, some people have a million excuses (both valid and invalid) for skirting their obligations. Unfortunately, lenders constantly deal with borrowers' excuses when it comes ...

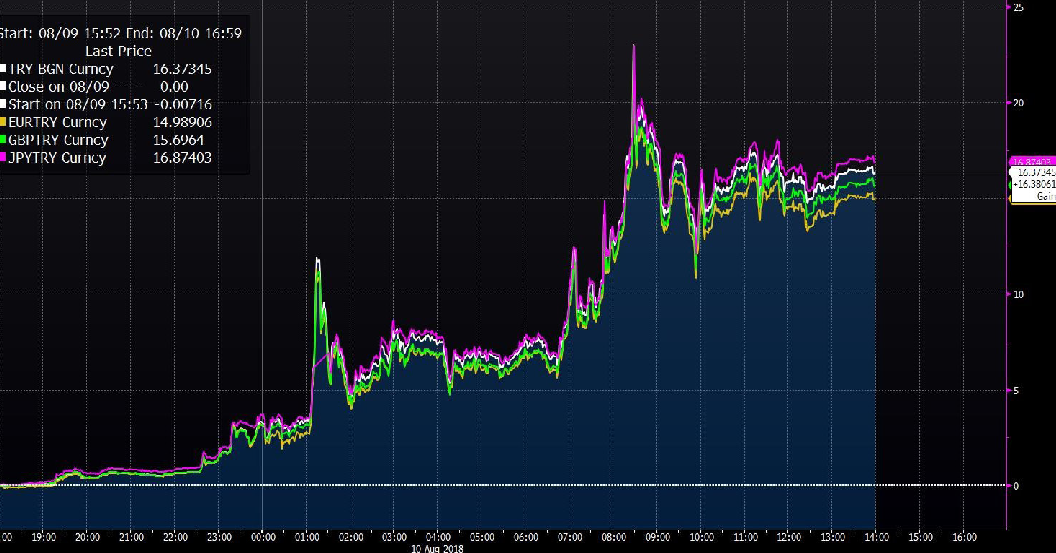

This week, emerging market investors were greeted by a plunging Turkish Lira, which as of this writing is down more than 15% relative to the major developed market currencies (see chart below). As carry trades are unwound as investors head for safety and lick their wounds, we are reminded of the volatility that erupted in emerging market currencies between 1998 and 2002. During this period, the USD strengthened to 15 year highs as multiple crises would break out around the world, most notably the Asian financial crisis, Russia’s 1998 default, Brazil’s 1998 real crisis, and Argentina’s massive devaluation following its default in 2002. The fall in the Turkish Lira that we have witnessed today, while significant, is still well below the losses that the Turkish Lira suffered on February 22, 2001, when the currency lost 30% against the USD.

To make matters worse, Turkish President Erdogan vowed to stand firm against market pressures and US political demands, where the Trump administration imposed sanctions on Turkey in response to the imprisonment of an American pastor. With the collapse of the currency and very few options available to stop the bleeding, as President Erdogan has stated his opposition to drastic interest rate hikes, the market is now trying to handicap the potential for contagion as well as the imposition of capital controls. According to a Bloomberg story, bank branches in Istanbul “indicated that foreign currency withdrawals had skyrocketed” and banks that were visited “reported that they were in more need to cash from headquarters."

The market responded to the news out of Turkey with broad selling across most equity markets around the world, with the most pain being felt in Europe due to the higher potential of contagion risks in within the banking system. The German DAX index finished the day off 1.99%, while the Italian FTSE MIB index fell 2.51%. It is worth noting that Germany is Turkey's largest trading partner, and Italian banks are holding a good size chunk of the $224B of exposure that foreign banks have to Turkey.

Emerging market ETFs, perhaps unjustifiably, also took it on the chin. The two biggest EM ETFs by assets, EEM and VWO, finished the day off by 2.13% and 1.99% despite having very little exposure to Turkey. The iShares MSCI EM ETF (EEM), which tracks the MSCI EM index, has a weighting to Turkey of 0.53%, while the Vanguard FTSE EM ETF (VWO), which tracks the FTSE EM Index, has a weighting of 0.61% to Turkish stocks. Some of this is currency related, as the DXY (USD index) broke through resistance to resume its trend higher (see chart), which is a headwind for EM equities. However, I believe that much of the damage was due to the market taking a “shoot first, ask questions later” approach to de-risking.

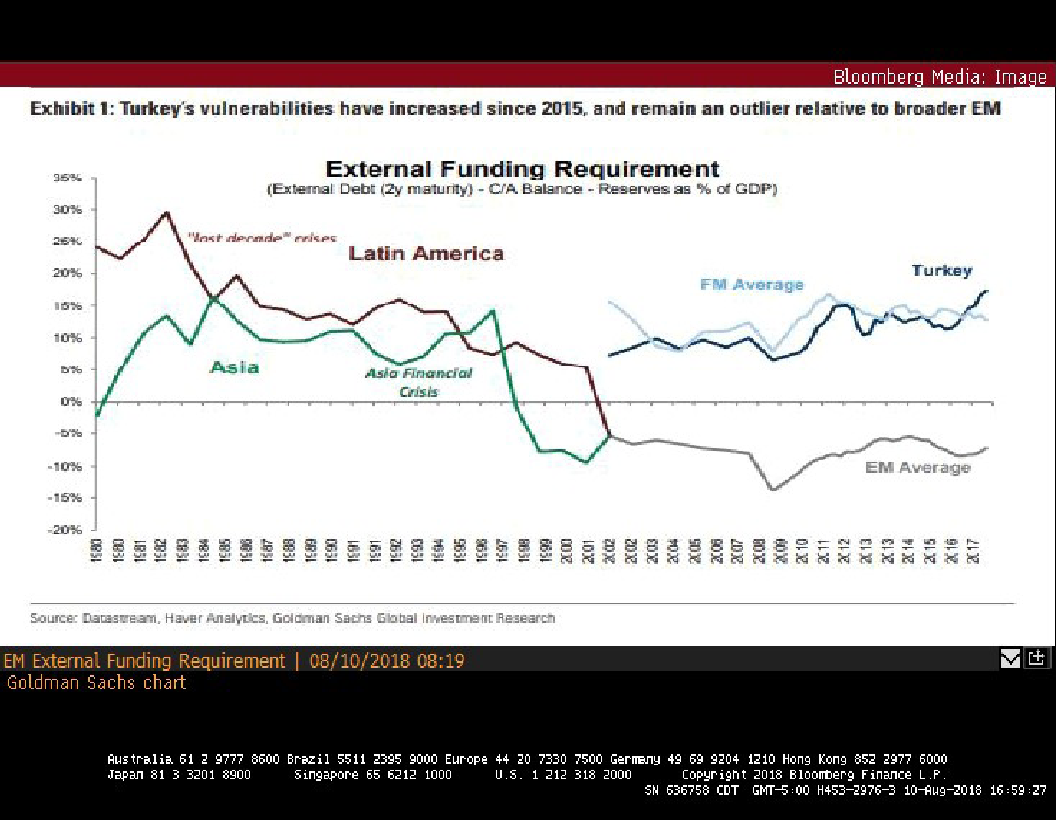

Goldman Sachs released a report this week on the external funding requirements for emerging market countries. The conclusion of the report was that Turkey, which has a large current account deficit and has relied heavily on external capital flows to fund its growth, is more of an outlier relative to the rest of the EM complex. While the regime of President Erdogan has done away with the idea of central bank autonomy, most of the EM countries have adopted more conservative approaches in an effort to become less cyclical. The end result is countries that are in a much better position to weather more Fed rate hikes and trade disputes, which was not the case 10 years ago. This recent sell-off in EM equities may be providing a good buying opportunity; one just needs to sift through the rubble to find the baby that was tossed out with the “bath water.”

Member SIPC & FINRA. Advisory services offered through SWBC Investment Company, a Registered Investment Advisor.

Not for redistribution—SWBC may from time to time publish content in this blog and/or on this site that has been created by affiliated or unaffiliated contributors. These contributors may include SWBC employees, other financial advisors, third-party authors who are paid a fee by SWBC, or other parties. The content of such posts does not necessarily represent the actual views or opinions of SWBC or any of its officers, directors, or employees. The opinions expressed by guest bloggers and/or blog interviewees are strictly their own and do not necessarily represent those of SWBC. The information provided on this site is for general information only, and SWBC cannot and does not guarantee the accuracy, validity, timeliness or completeness of any information contained on this site. None of the information on this site, nor any opinion contained in any blog post or other content on this site, constitutes a solicitation or offer by SWBC or its affiliates to buy or sell any securities, futures, options or other financial instruments. Nothing on this site constitutes any investment advice or service. Financial advisory services are provided only to investors who become SWBC clients.

Related Categories

Capital MarketsJosh Lynch

Josh Lynch assumed the position of Director of Portfolio Management of SWBC Investment Services, LLC in 2014. He is responsible for managing all of the firm’s proprietary portfolios. He began his career in risk management with a Fortune 500 company. After 11 years, Josh transitioned to financial services joining Merrill Lynch in 2009. He joined SWBC Investment Services in 2011 as an Investment Associate, where his focus was on portfolio strategy and analysis. He also partnered with the Wealth Management team in providing customized portfolio solutions to corporations, defined benefits plans, non-profit organizations, and high net worth individuals. Josh is a graduate of Florida State University with a Bachelor of Arts in History and Economics. He earned the Chartered Financial Analyst (CFA®) designation and holds FINRA Series 7 and 66 licenses.

Let Us Know What You Thought about this Post.

Put your Comment Below.