In an increasingly digital world, consumers expect a frictionless, omnichannel experience from their banking providers. Any form of friction — especially in digital channels — which inhibits users from intuitively and easily achieving their goals, is deemed unacceptable. If consumers encounter friction in any routine banking task, they will reshape their view of the institution, and the banking brand will take a hit.

Traditional financial institutions can reframe the situation through a lens that’s a bit more positive: Wherever there is friction, there is opportunity. Banking executives can build their organization’s branch by hunting down all point points lurking in their customer experience and quashing them.

This must be done urgently. Startups and fintechs are challenging incumbent financial institutions by finding opportunities to remove friction across all touchpoints in the customer journey. Opportunities to innovate abound — from the digitization of back-end process to point-of-sale service offerings and task automation, even the reinvention of “money” itself.

The proliferation of alternative players providing an escape from banking friction is a real threat. These agile competitors, such as payment innovators Venmo and Cash App, are capitalizing on the financial industry’s failure to keep up with the frictionless future.

Here’s a real world example. A bank customer in a focus group recounts a desperate call he received from his daughter. She needed funds to repair her car immediately. So he logs into his online banking portal and attempts to transfer money to her. But he only had two options: ACH or wire transfer, and both would take two to three days. He called the bank’s customer support hotline. After several minutes, during which the same funds-transfer options were explained, the bank’s rep suggested the customer go to Western Union! Unbelievably, the customer and his daughter banked at the same institution, in the same town.

Did he go to Western Union? Nope. He downloaded the Square Cash app, where he took a photo of his debit card, entered the amount to transfer, and his daughter’s email address. Within minutes his daughter called to thank him for sending the money.

This is a perfect example of the impending disruption awaiting traditional financial institutions that don’t keep up with the frictionless future. When legacy businesses can’t keep pace, consumers will search the internet for a way around them. The reality is that a number of third-party apps can move money more efficiently within a bank’s own walls than many banks can do themselves. The technology these peer-to-peer apps use is relatively simple, and their success in the market speaks volumes to the traditional institutions’ back office inefficiencies.

Highly Recommended: The Simplicity Revolution in Banking

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Battle Lines Are Being Redrawn

In the old days, banking providers competed with each other to attract consumers to brick-and-mortar branches. But the battleground has shifted to mobile devices. Consumers now evaluate banks and credit unions based on the quality of experience with digital channels. Financial institutions are only now starting to catch up, as they scramble to create mobile experiences that are competitive.

If they don’t want to continue losing ground to fintechs and disruptive challengers, they had better start looking to the future, where agility and adaptability are central themes. A perfect example of this is the rapidly evolving field of voice assistants. What could be easier than using smart speakers from Amazon, Apple, or Google to ask for your account balance through? Voice identification technology will soon be secure enough to replace passwords, allowing people to perform even more complex financial tasks with even greater ease.

Further, highly personalized financial products and services featuring one-click convenience are now being offered by unexpected players at exactly the right time in the customer experience. Amazon shoppers are offered personalized point solutions for loans, insurance, and rewards at key moments in the customer journey. Even deeply developed marketing and brand loyalty cannot compete with such convenience.

The Autonomous ‘Self-Driving’ Bank Account

Digital DIY interactions will always have some element of perceived friction — self-service usually means the consumer is absorbing some burden. The ultimate in frictionless financial services will be delivered autonomously via advances in artificial intelligence. It may be quite some time before we each have our own personal smart financial companion bot operating autonomously on our behalf, and in our best interests, but there are countless entities investing significant resources to bring this idea to life.

It’s likely that banking will become a background service we subscribe to in which we have “self-driving” bank accounts optimizing our finances based on our stated and predicted needs. There are a few barriers beyond technology to overcome before this occurs though. Trust in the institution is paramount to adoption. And given the current shift from “institutional trust” to “distributed trust” financial institutions have some work to do before they can play successfully in this arena.

Read More: AI & the Future of Autonomous ‘Hands-Free’ Banking

The Incumbents’ Potential Trump Card

“Challengers at some point will begin to feel the gravity of what it means to be a ‘real’ financial institution.”

There is hope for incumbent financial institutions. The challengers for the most part are primarily focused on customer acquisition via very narrow solutions. At some point, they’ll be forced to focus on retention, as well as, breadth and depth of services. It’s at this point they will begin to feel the gravity of what it means to be a “real” financial institution, and not only because of regulatory compliance issues.

Millennials who’ve adopted these fintech apps will soon have more sophisticated financial needs and will wish to consolidate their financial views. Incumbent institutions should find that they have the right-to-win as providers of holistic advice and services.

This, of course, assumes incumbents have their digital house in order so as to advance their position further along the financial value chain.

Search And Destroy: Eliminating Friction From Your Experience

First, get tactical. Start with a customer journey-mapping initiative to understand all aspects of the customer experience. These efforts will reveal where customers are forced to switch interaction channels, enter redundant information, endure long wait times, etc. A holistic customer journey map will also reveal back-end systems, workflows, and processes which contribute to perceived friction by your customers.

As another rich source to identify customer friction, be sure to audit your contact-center transcripts for key issues. Look for issue severity as well as issue frequency.

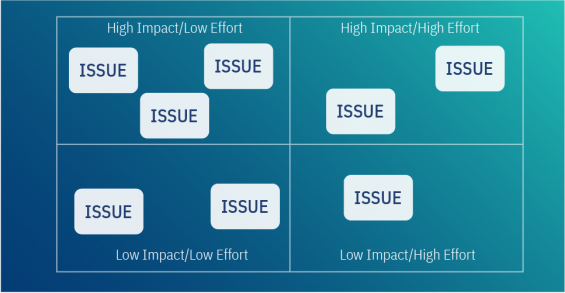

To guide issue prioritization, begin by plotting each issue along an axis. Ask yourself how much impact the issue has on your customers (impact can be in terms of the number of customers or value of the task they are trying to accomplish). Then assess the relative level of effort it will take to fix the issue. The result should be a graph of your issues relevant to their impact and effort. Be sure to do this exercise with a multi-discipline team (i.e. business, design, engineering, etc.)

Take your chart and overlay a 2×2 matrix on it. This will help prioritize the various issues in their appropriate impact/effort box. Address the high impact/low effort items first. Next, assess the high impact/high effort items to see if these efforts can be broken down into easier phases.

Second, be strategic. It’s been said that big ideas begin with small steps. Many emerging technologies promise to further reduce friction for your customers. If you want the competitive advantage; assemble a “tiger team” to explore emerging technologies such as voice interfaces, blockchain or machine learning. Ensure that they work closely with the day-to-day business to identify existing initiatives in which to begin testing a few foundational features that improve the customer experience.