Sometimes it pays to dip a toe in the water before taking the full plunge.

That's the view of First Merchants Corp. in Muncie, Ind., which recently agreed to

Buying the stake seems like "a prudent investment whether they sell or not," said Mark Hardwick, First Merchants' chief operating officer and chief financial officer. "I don't know that it's a great strategy ... [but] it's one that helps us maybe have an advantage when the time comes" for Independent to sell.

It is uncommon to see a bank obtain such a large stake, since small banks like the $1.1 billion-asset Independent often have very illiquid stock, said Damon DelMonte, an analyst at Keefe, Bruyette & Woods.

There have been times when a bank ended up with a minority stake in another institution, but it often occurs when a borrower defaults on a loan where the stock was put up as collateral.

For instance, Beneficial Mutual Bancorp in Philadelphia

First Merchants, for its part, is buying shares from a private investor and affiliated trusts. The stake was the largest in Independent, based on a 2014 prospectus filed by the bank.

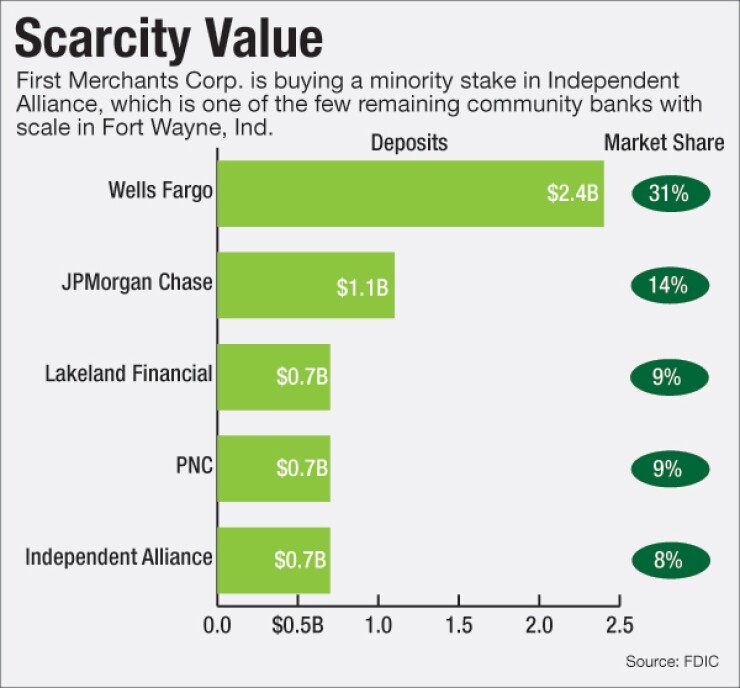

The move makes sense, given the attractiveness of Fort Wayne and Independent's position as one of the few remaining banks of size in that market, said Scott Siefers, an analyst at Sandler O'Neill.

"Testing the waters with a small upfront investment seems like a reasonable way" for First Merchants, Siefers added. "If nothing else comes of it, the stake strikes us as a good way to gain market intelligence."

For now, the investment will be treated as any other equity security, where dividend income will be recorded as net interest income and the stock price will be marked-to-market on a quarterly basis, DelMonte noted. "We think this investment helps lay the groundwork for a more meaningful future investment."

First Merchants, meanwhile, has lost out on at least three potential acquisitions due to its "really prudent pricing discipline," Hardwick said. He noted that First Merchants has bought a minority stake in another bank before – Anderson Banking Co. in Indiana – several years before buying that institution outright in 1999.

Mike Marhenke, Independent's chief executive, said he was unaware of the pending sale until First Merchants filed documents disclosing the transaction, adding that he was surprised to discover that the buyer is a bank.

"After talking to them and understanding their position, I guess I'm not overly concerned that they're taking any active role in purchasing the company," Marhenke said.

While Independent has not expressed an interest in finding a buyer, certain factors could make the bank a seller in the future, said Kevin Reevey, an analyst at D.A. Davidson.

"Given the age of the board and management, I would not be surprised if they are sold sometime within the next three to four years," Reevey said. "First Merchants would be the logical buyer of choice."

Paul Davis contributed to this report.