Growth Loops – The New Way To Grow Bank Product Sales

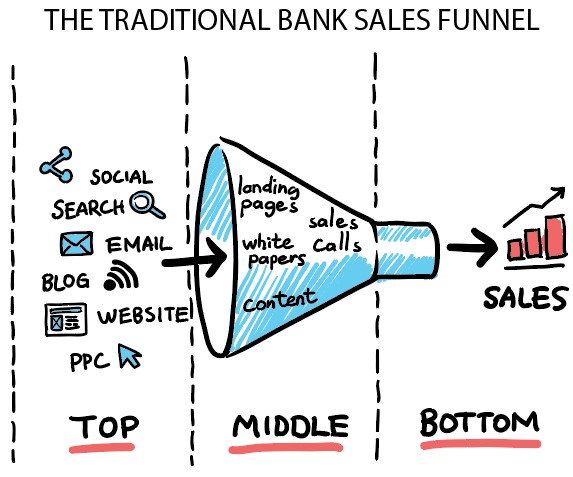

Most banks think in terms of linear growth. As a result, bankers love the idea of a sales funnel – put enough prospects at the top of the funnel, and a certain number of customers will fall out the bottom. Add more resources, and you get more customers. It is easy to understand. Unfortunately, there are many problems with sales funnels, and in this article, we will show why banks should be thinking in terms of “Growth Loops” instead.

Shortcomings Of The Current Growth Mindset

Here is a fun exercise – Ask a bank product team, “How do you grow customers?” The answers will be all over the board. This is the first problem. Some will not know the answer, and other bankers will talk about more marketing, more salespeople, more geography, better follow-up, or a more focused sales effort.

The second problem is that while the answers are not likely wrong, they are most likely incomplete, at odds with other objectives (such as cost control), or have more output focus than input focus. While that last point seems silly, it is a far too common of an occurrence for a bank to budget higher revenue but try to hold expenses constant as if sales were magically going to materialize.

Finally, the product itself is usually ignored when talking about sales growth which is like ignoring half the problem. The value proposition of the product is perhaps the single largest factor in driving sales growth, yet it is often ignored.

When was the last time you improved your loan, deposit, wealth, mortgage, or treasury product? Your bank might have introduced a new product, but very few banks go back and try to improve an existing product unless forced to by the regulators or changes in technology.

The Problem with Funnels – Sales over Product

The biggest problem with sales funnels is that it focuses bankers on the sales process rather than the product. Not that there is anything inherently wrong with a sales funnel, only that it leads to sales myopia if not taken in context. As mentioned above, it takes focus away from creating a brand and a value proposition in a product.

Funnels Create Strategic Confusion

Sales Funnels also cause strategic tunnel vision. Instead of thinking about how you can grow customers, the commercial lending team often thinks about increasing loans. The branch thinks about increasing deposits, and Treasury Management thinks about growing treasury management. This problem is often magnified when marketing gets involved as marketing then goes off and creates a strategy based on the bias and limitations of what the product people told them.

For example, instead of creating a more appealing lending product and targeting a niche customer segment for a high return on investment growth number, marketing takes an existing product and tries to amplify it with email, digital or social media marketing. Neither the product staff nor the marketing staff knows what they don’t know. Because everyone has the mindset of the funnel, neither department takes much time to understand the customer, the intent, the metrics (like profitability over revenue), or the interactive role between product and marketing strategy.

Funnels Create Tactical Confusion

The above strategic confusion then carries through to the tactical level. Since a bank has an omnichannel approach, there is often misalignment between mobile, online banking, the branch network, marketing, and management. The customer experience is different, how each handles sales leads is likely different, and the product itself is often different.

A large national bank is recently infamous for introducing a millennial targeted mobile account that failed mainly because the branch didn’t get credit for account openings. When prospects went into the branch for help, they were often talked out of the product and into the traditional mobile bank product. The result was $80+ million in marketing and product dollars wasted because of siloed funnel thinking that causes strategic and functional misalignment.

Since funnels only operate in one direction, it is common for banks to assign different parties to different parts of the funnel. Marketing usually owns the top of the funnel, while sales owns the midpart of the funnel, and operations owns the very bottom of the funnel. Marketing may jam the funnel with lower quality leads to meet their targets which bog sales down, causing them to miss their targets.

Also significant is that it is rare for anyone in a bank to own the post-closing experience since that usually lies outside the funnel.

The knee-jerk reaction to solve the sales problem is to put more prospects at the top of the funnel and spend more money on marketing or sales. Meanwhile, the return on investment drops with each dollar. There is no compounding effect, no flywheel, no network effect, and little overall orchestration of the process.

So, what is the better way?

The Rise of the Bank Growth Loop

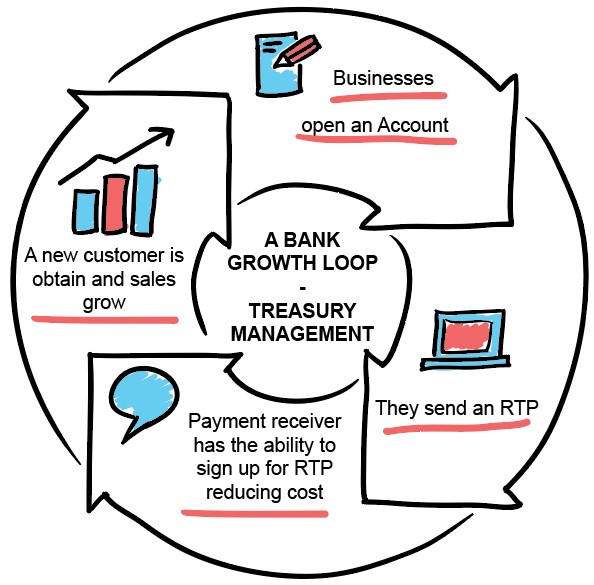

Now, if you are Venmo, Chime, Facebook, Amazon, Uber, or any number of fast-growing companies, you believe in the growth loop over the sales funnel. Growth loops are systems where growth can occur geometrically, not linearly, and the return on the system’s inputs are higher. Growth loops can be designed to achieve the various goals of the bank, such as revenue growth, customer growth, efficiency, customer retention, or increased product engagement.

The hallmark of a growth loop is a product attribute that encourages certain behaviors, like customer acquisition, in the PROCESS of usage. When it first came out, many bankers laughed at the social media aspects of Venmo with its use of emojis. However, it was its use of emojis that created the growth loop. The more customers used Venmo, the more social media posts took place, and the more people saw their friends using Venmo. As one person received payment, they signed up and started using the product as well.

Banks can use this same growth loop as well as they start to roll out real-time payments (RTP) within their treasury management product offering. Allowing one business to send out a request for payment or a payment provides the opportunity to not only collect payment but to market as well. As each counterparty receives the payment or the request for payment, an incentive can be added to get them on the RTP payment platform. Thus, with each payment, banks have the opportunity to pick up new customers and create what is known as the “flywheel effect” in marketing (below).

Note the important mind shift here. By focusing on how to create a growth loop, you have to focus on the product as much as sales and marketing. This makes a more efficient allocation of resources and keeps bankers focused on the product’s value proposition. As new attributes are added to the market, sales and marketing have more to talk about with their customers. As the product’s value proposition becomes so great, customers will start to talk about a bank’s product with other customers.

Chime recently created a growth loop with their Early Direct Deposit product and again with their SpotMe product, as they did away with overdraft charges. As we wrote about earlier HERE, NuBank did this with their credit referral product when it found the customers that get referred to NuBank, had better credit. As a result, NuBank not only created a new instant credit product but incentivized all parties to help with referrals and conversions. The result is geometric growth.

The K-Factor – Compounded Growth

Growth Loops not only change the mindset but create sustainable growth that compounds. Once a quality growth loop is set in motion, it can operate independently, often with very little additional marketing or sales resources. Here, we measure the quality of the loop by its “K-factor,” sometimes called the “K-Stat.” The K-factor is the relationship of current customers to newly acquired customers. If a current customer results in three new customers a year because of the growth loop, that loop has a K-Factor equal to “3.” It is not uncommon to see loops generate K-Factors of 100 to 500 in high-growth products. Compare that to a normal bank product relying on a sales funnel, and the K-Factor is usually closer to 0.2.

Growth Loops Force A Wider Picture

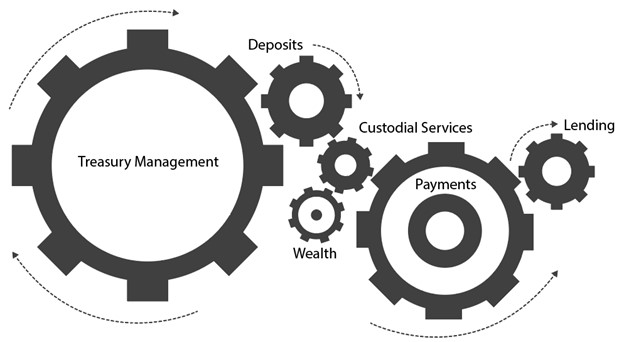

To manage a growth loop, you are forced to think more holistically, considering the product, marketing, sales, channel, and business model. This often prevents you from thinking in silos and leads to more bundling of products, which is the formula for greater cross-sell and profitability.

Further, loops come in different sizes or effectiveness and can be combined for even more tremendous growth. Treasury management can result in more deposit customers, resulting in more custody work, wealth fees, greater use of payment services, and then lending. Each product starts generating customers and leads for the other products. Have a loan out to the customer, and you sell them the ability to make automatic, real-time principal and interest payments. They like the real-time payments product and want to start paying all their suppliers and customers that way. Those payment streams not only lead to new customers, as mentioned above, but you also sell treasury management services to each of those new customers, the analytics of which leads to more deposit, wealth, and custody customers.

Not only do loops cause the bank to strategize differently, but also to organize differently. Since marketing, sales, product design, and other departments play a significant role in the process of growth loops, the bank is pushed to more teams organized around the process instead of departments. This team-of-teams approach creates more diverse cross-functional teams that work more efficiently since they are now better aligned.

Putting Growth Loops into Action

Growth loops abound in banking and are about to be more prevalent as banking-as-a-service becomes more popular and banks leverage fintech companies to expand their wares. Instead of building and buying a new product and managing growth through the lens of a sales funnel, think interconnected growth loops instead.

Banks need to start early in the product’s design to figure out how to build connections to other products and to the process of acquiring other customers. Assemble cross-functional teams early to derive product input. Don’t build the product and then market it. The essence of growth loops is that you bake marketing into the product. Then, continue to evolve products to improve both sales and engagement.

Review your business model and ask your team how you can attack the market through non-traditional ways such as embedding your banking service into other workflow or applications? How can you grow through partnerships? How can you make pricing different to amplify conversions or engagement? Can you offer a free trial? Can you bundle the product into another service package and charge more?

Another major lesson learned by banks is to start with a particular customer niche. This is an excellent way to start building a growth loop. Understanding the needs of a customer segment such as municipalities, homeowner associates, hospitality, gig workers, technology platforms, or any other customer type allows you to build a value-laden product and use the product attributes to grab other customers.

Think about the interactions of your customers with their customers. Growth loops frequently get fueled by answering the question of how can you make it easier for your customers to serve their customers?

After product design, then think about sales and marketing strategy in order to figure out how can you quickly scale the product through referrals, social media, promotions, or content in order to drive growth?

Do this all correctly, and not only will your product growth go from single digits to far beyond, but your mindset will change and positively impact everything your bank does, from hiring to managing. That is the power of growth loops.