You’ve probably heard all you need to hear about Davos by now, so I won’t bore you with it much further … except for this. Much of the dialogue for the past year has been about climate change or climate emergency or climate action or whatever you want to call it. Between David Attenborough, Greta Thunberg and Extinction Rebellion, you kind of cannot miss it.

But then I sit here and wonder why. We talked about climate issues twenty years ago. Al Gore even made a movie and got a Nobel Prize about it. So why is it hot, hot, hot now? I guess because the Earth is getting hot, hot, hot now.

At Davos, you couldn’t move for some discussion about climate change. It’s five of the top five issues on their Global Risk report. Not number one or number two, but numbers one, two, three, four and five. All five of the greatest risks to the world today are climate risks.

This does not surprise me.

In fact, what surprises me is that we are still taking about this stuff and not doing something about it. You may say, but we are doing something Chrissy-wissy. We have a sustainable finance guy. We’ve been doing CSR for years. We are accountable and responsible.

I say, get out of here. You’re all just air.

Now, I’m being harsh here, but some friends in the network have been sharing some behind the scenes stuff, like this great article that appeared on Euromoney in December.

Here’s a few highlights:

“Of the world’s largest 50 banks, 25 have made public sustainable finance commitments totalling more than $2.5 trillion according to data released in October by the World Resources Institute (WRI).

“JPMorgan Chase, for example, committed to facilitating $200 billion in clean financing between 2016 and 2025. Bank of America has committed to mobilizing an additional $300 billion in capital through its Environmental Business Initiative between 2020 and 2030. Société Générale has committed to raising €100 billion in financing for the energy transition between 2016 and 2020.

“As more banks have announced hundreds of billions in commitments over different timeframes, WRI was asked to shed light on whether such commitments are impactful; its findings were indicative of what many have suspected: there is little way of knowing. What WRI discovered was that 57% of the banks that have made commitments don’t publicly disclose their accounting methodology … and a third don’t even have plans to report on the progress of those commitments.

“‘These commitments are just nonsense,’ comments one former sustainable finance head. ‘You don’t run a bank that way – putting out a notice that you’re going to finance $150 billion or something in renewables. Finance is driven by the credit people. ‘I guarantee at monthly meetings these targets aren’t being checked. It’s just a number these banks know they’re going to meet because the renewables industry is growing. In addition, people doing the work in sustainable finance are often isolated from the boards making these sweeping statements.’

“A sustainable finance head adds: ‘These targets are only set because banks know they will meet them. Banks are not going to say something radical. It’s also a distraction. The whole focus should be on real lending books, not this small portion of green financing anyway.’

“WRI’s data also showed that 28% of those banks making a commitment don’t disclose the types of financing they include and those that do have wildly different approaches to sustainable finance.

“‘Definitions vary so widely that it's hard to get a clear understanding of what is being done and impossible to make comparisons’ - Giulia Christianson, WRI. HSBC, for example, includes asset management in its $100 billion sustainable financing commitment. JPMorgan’s $200 billion is specific to clean energy financing. BNP Paribas’ €185 billion targets the UN Sustainable Development Goals (SDGs). BBVA’s €100 billion pledge encompasses green finance, sustainable infrastructure, social entrepreneurship and financial inclusion. ‘Definitions vary so widely around sustainable finance that it’s hard to get a clear understanding of what is being done and impossible to make comparisons,’ says the report’s co-author, WRI’s head of sustainable investing, Giulia Christianson …

“One area of sustainable finance that should be less opaque given the formal framework around it is the green-bond market, but even here impact is difficult to measure. While green bonds have been praised for bringing ‘use of proceeds’ into the debt markets, a study by the Climate Policy Initiative (CPI) released in November showed that it is not as transparent as some would like to believe. Chavi Meattle, who co-authored the CPI’s report, the Global Landscape of Climate Finance, says that, of $53 billion in green bonds and loans tracked by the Climate Bonds Initiative (CBI) – widely regarded as the most thorough green-bond database – only $2.8 billion in annual primary investment for climate action could be identified in the post-issuance reporting. It highlights ‘the clear disparity between total issuance and the amount of new investment that can be tracked within green-bond reporting practices,’ says Meattle, and shows that ‘significant improvements are needed to ensure full market transparency and timely disclosure of use of proceeds …’

“There is also the uncomfortable fact that set against traditional finance, green-bond financing looks small. Some $202.2 billion in green bonds and loans was issued up to October 22 this year, according to CBI, and one third of that financing was within the energy sector – $66.7 billion. It is difficult to make accurate comparisons with the larger market but as a guideline, data from Dealogic shows the energy sector as a whole raised $555 billion in traditional bonds and loans over the same period – about eight times as much. The same goes for sustainable finance more broadly. There is no accurate way yet of showing sustainable financing from banks versus brown financing, but WRI offers as a comparison banks’ sustainable finance commitments from last year – $292.3 billion – against Rainforest Action Network’s data on fossil fuel financing from the top 33 banks alone for last year – $654 billion – more than double. JPMorgan, for example, financed $63.9 billion in the fossil fuel sector in 2018 – $18.01 billion was for oil, gas and coal companies expanding fossil fuel production or extraction. These figures offer some perspective on the bank’s average annual sustainable finance commitment of $22.2 billion.”

I suggest you read the full article for perspective, but it builds on my own skepticism around sustainable finance, much of it stemming from PR talk versus actionable walk. Most of what I see in this space is the former and little the latter.

By way of example, one of the most formidable investment firms in the world is Blackrock. Larry Fink, their chairman, issued his advisory note this year telling all:

“Our investment conviction is that sustainability- and climate-integrated portfolios can provide better risk-adjusted returns to investors. And with the impact of sustainability on investment returns increasing, we believe that sustainable investing is the strongest foundation for client portfolios going forward.”

Yada yada yada, blah, blah, blah, blah, blaaaaaaaaaaaah.

Thanks Larry. Unfortunately most of what you see is full of BS .It’s a bit like Barclays leading the fray in responsible investing whilst being Britain’s leading fracker. I just don’t buy it.

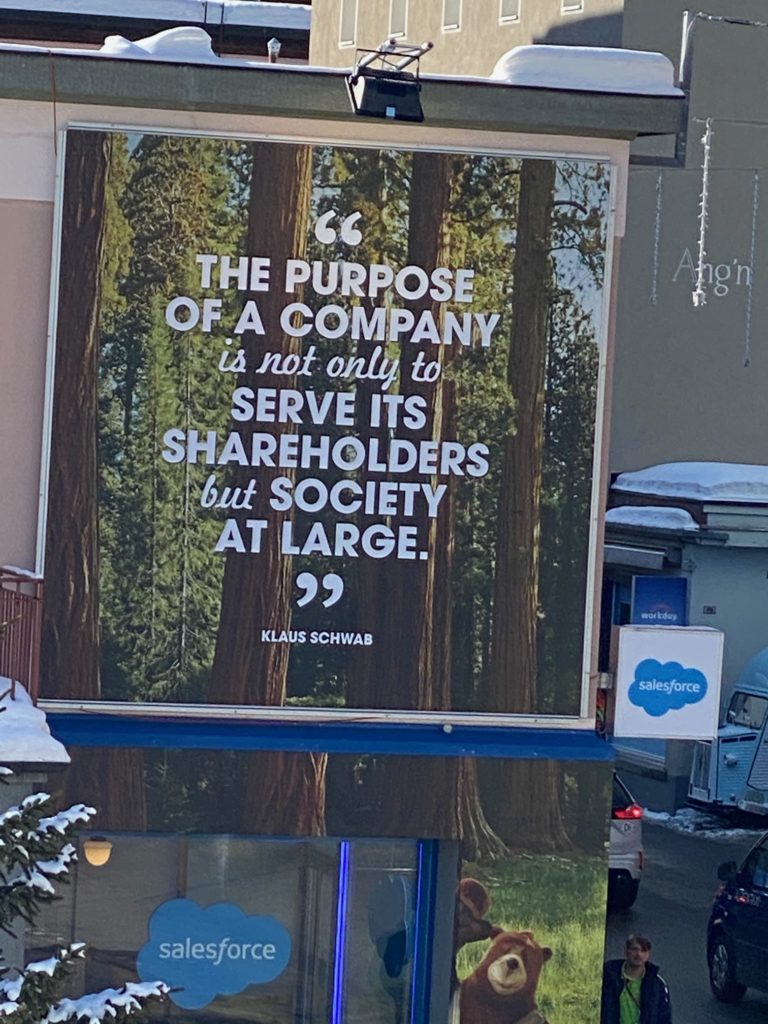

This is where purpose-driven banking steps in. In most of my writing about this space, people tell me that the reality is shareholders come first. Forget stakeholder capitalism – another big theme of Davos …

… it’s all down to shareholder capitalism that the planet’s future is fracked.

I’m fully convinced that this will change. It won’t be due to shareholders, investors, banks or climate activists like Greta Thunberg though. It will be down to governments and regulators. If governments and regulators make banks and investors fully accountable for their portfolio and ensure that it manages climate risks as actively as it does economic and political risk, then things will change.

Anyways, right now, it’s not sustainable finance that’s making a difference at all. If a bank says they are throwing $100 billion into renewables, might they have been throwing $100 billion into renewables anyways, as it’s a growth market? What we really need banks to be doing is throwing $100 billion into renewables at the expense of $100 billion in unsustainable funding in non-renewables. And we need to measure that and make banks accountable for it. That’s what’s going to change. That’s what governments will focus upon. And that’s what’s going to make a difference. Not just talk, hot air and gas, but real change of portfolio, risk and investments from the unsustainable to the sustainable that is measured, managed, regulated and accounted for.

Thank you.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...