As a child of the ’80s, I loved the “choose your own adventure” books. The idea that, as a child, I could control the outcome of the story I was reading was simply mind-blowing. Therefore, with ’80s-themed nostalgia seemingly everywhere at the moment, I thought I would add my own personal ’80s reference and apply it to our work in lending—and so I bring you “Choose your own adventure: A digital lending story!”

Branch doors have reopened at banks around the world as lockdowns have subsided. As you readjust and start thinking about the future, how can you capitalize on the changes you introduced out of necessity during the COVID-19 pandemic? Well, here is your first choice! Many businesses are rethinking their presence in the physical world, but you—a heroic bank—should not underestimate the value of your brick-and-mortar assets as part of your digitalization strategy.

Banking customers can now consistently access a wide range of financing options without face-to-face interaction and without signing physical papers. Emerging online lenders had a head start in digital lending, but traditional banks have closed the gap. Incumbents have the advantage of an existing physical infrastructure, allowing them to complement their digital offerings with in-person and phone-based service to customers. I expect the way forward for many banks will be a hybrid approach that allows customers to choose their own adventures—that is, how they want to interact with lenders.

In a recent Small Business Credit Survey, large banks achieved a customer satisfaction rating 35 percentage points higher than online lenders, while small banks outscored them by 49 points.

Choose to combine the best of both worlds

A large number of customers embraced digital banking during the pandemic—even Baby Boomers, who have historically preferred in-person service, moved their banking online along with their grocery shopping and medical appointments. And those shifts are unlikely to be reversed as the pandemic recedes. However, when it comes to major financial events like buying a home or arranging a business loan, many customers still choose to get personalized advice at this crucial point in their stories.

“You need to balance the human and digital relationship. That’s what will make the next cohort of banks unique.”

– Helen Sullivan, Senior Vice President, American Bankers Association

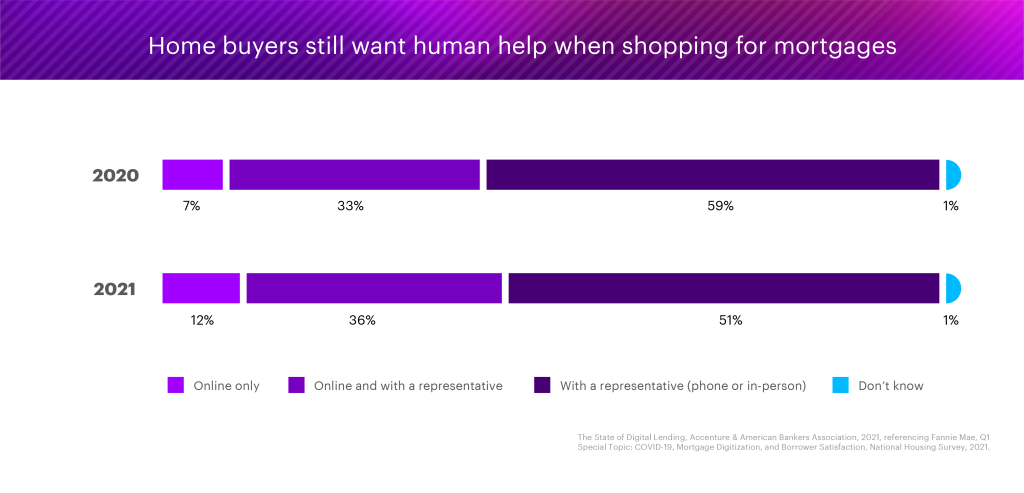

According to Fannie Mae, only 12% of home buyers set up their mortgage using a digital-only platform in Q1 2021. More than half worked with a representative exclusively in–person or on the phone to set up their mortgage, while 36% used both a representative and an online platform.

This is great news for incumbent banks, but perhaps it isn’t so surprising that when it comes to the biggest purchase of most individuals’ lives, they want to talk it over with a real person. However, to keep customers happy and keep up with the times, banks will need to combine the advanced data analytics and faster processing times that fintechs are known for with the one-on-one service that borrowers still value.

This hybrid approach helps traditional banks optimize relationship managers’ limited time. By automating much of the paperwork and compliance involved in lending, banks free up their employees to spend more time providing personalized advice to clients. Combining this high-value service model with the ability to offer their customers more choices about where to conduct their banking—on a desktop, smartphone, tablet, ATM, on the phone or at a branch—can provide a level of comfort and support that is difficult to achieve with an online-only approach.

To truly benefit from the time and money saved through automation, banks should invest in their talent by upskilling advisors and relationship managers, and should provide them with high-quality data to deliver the value-added service to customers that sets the bank apart from strictly digital offerings.

Choose to turn competitors into partners

Digital-only lenders may have set out to disrupt the banking establishment, but their future role appears to be partnering with the very banks they threatened to make obsolete. Fintechs have expertise in areas that traditional banks struggle with, such as embedding financing into transactions to make them fast and invisible, leveraging alternative data sources for credit decisions, using artificial intelligence for targeted offerings and personalized experiences, and moving quickly to market with new innovations.

Incumbents, on the other hand, have the advantages of strong customer loyalty, a deposit-taking structure that gives them lower cost of funds, and an existing branch and phone banking infrastructure that offers offline options for customers who prefer the hybrid approach.

By teaming up, fintechs and banks can offer new levels of customer service that neither can deliver alone. Younger generations of customers are no longer interested in simply being sold a product, such as a loan or a line of credit. Instead, they are looking for providers that can help them achieve their goals. Whether that goal is buying a home or starting a new business, they want to access information, support and guidance through whatever interface is most convenient for them at that moment. Banks that leverage their partnerships to make the customer journey smooth and efficient will flourish, where those still mired in paperwork and manual processing will continue to lose ground.

Choose a future-focused mindset

Digital lending is part of a shift in financial services that has permanently changed customer expectations. The advancements that took hold during the pandemic were widely embraced, and like a rubber band that has been stretched too far for too long to snap back, “banking from anywhere” is here to stay.

While the initial shift occurred in personal finance, commercial lending is already starting to experience the same disruption. The blurring of lines between work life and home life has spilled over into the banking world. Now that society has witnessed what’s possible in personal banking, B2B customers expect their business banking to be just as slick and efficient. The intuitive experience is still in its infancy in commercial banking, but banks are rapidly moving towards a new digital horizon.

Banks need to think about their lending practices as an ongoing story. New technology is emerging and customer and client expectations continue to evolve, creating new chapters and choices. The bank’s digital ecosystem must work as a cohesive unit by adapting sales, talent and processes to this new hybrid model. A combination of out-of-the-box solutions that can be quickly implemented, coupled with a long-term plan to advance their capabilities, will enable banks to undertake their digital transformation in a responsible and achievable manner. So here we are—the choice is yours. Which path will you choose for your digital lending adventure? You get to turn the page and find out!

To discuss your digital lending strategy and the next chapter in your journey, contact me here.

Get the latest blogs delivered straight to your inbox.

Subscribe