As the way we exchange value changes, taxation faces a pivotal moment.

Historically speaking, taxes have been taxing.

This is more than a silly joke—though I will grant that it’s also that. Since the inception of taxes, the payment and collection of them has been filled to the brim with delays, hassles, and needless complications.

But new developments in the payments ecosystem—Open Banking, ISO 20022—are about to change all that.

A brief history of taxation

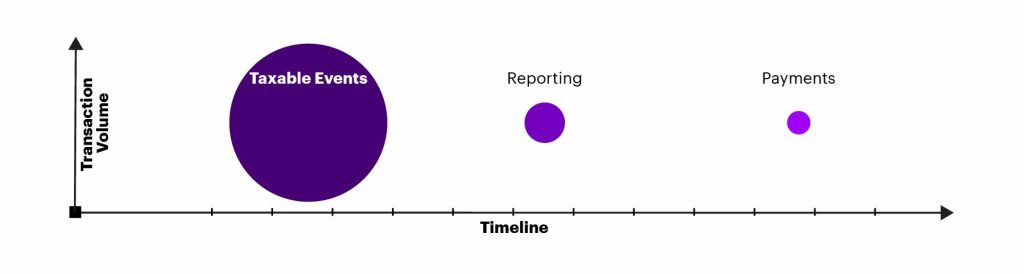

You can divide the payment of any tax into three separate events: the taxable event itself, the reporting of the event to the tax authority and any other relevant parties, and finally the payment of the tax.

For most of the modern history of taxes, these events have all taken place in the order mentioned, separated by time.

The gaps between each event created opportunities for errors, inaccuracy and aggravation to enter the tax system.

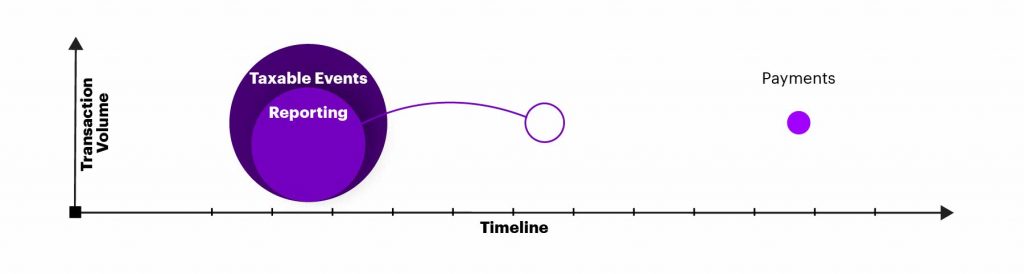

Thanks to the digitization of financial services, we’ve been able to improve this system. Today we incorporate the reporting of taxable events simultaneously with the events themselves.

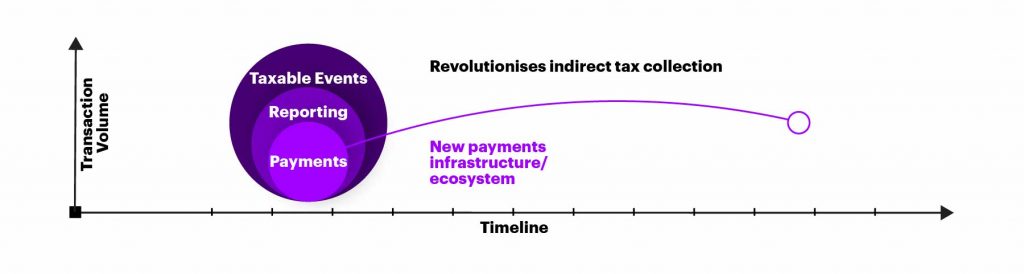

This is a major improvement, but still leaves a gap between the tax event and payment where entropy can sneak in. Bringing payments inside the circle is something of a holy grail for taxation.

And the payments revolution will soon make it happen.

Payments innovation goes mainstream

In the last year, the steady beat of payments change has started to feel like a drumroll. The pace of both innovation and investment in payments have radically accelerated. What does this innovation mean for tax collection? There are two main areas where we see payments innovation having a significant impact on taxation:

1. Split payments

Emerging technologies like 5G allow for access and penetration, bringing the potential for micropayments and more online connectivity. Payments will be split into multiple segments, allowing for more regular, frequent engagement.

If certain tech and liability risks can be mitigated, the potential here is considerable. Consider that taxes could be collected directly at the point of sale. For example, the 20% VAT could be sent to the government at the point of purchase, eliminating the need for merchants to collect, track, and remit this themselves. Payroll tax could likewise be automatically sent to tax collection agencies at the moment paycheque is sent.

2. Richer data

Growing use of digital payments, new standards like ISO 20022, Open Banking, and digital currencies are boosting the quantity and quality of data available to tax systems. This will provide opportunities to:

- Make it simpler for taxpayers to pay the right amount at the right time. Providing an Amazon-like customer experience will soon be a very realistic goal for tax authorities.

- Remove barriers to compliance—especially for small- and medium-sized businesses, which often struggle with the administrative work of taxation. Again, an Amazon-like CX for these merchants should be the goal.

- Make post-event collection easier and faster for all parties involved.

- Eliminate error and related admin tasks.

Combined, these improvements represent the chance to recover billions of pounds lost to tax evasion and compliance gaps. This could have a transformative effect not only on those who pay or collect tax, but on society as a whole.

If you’d like to talk through the payments revolution, and the challenges and opportunities it presents for taxation, I would love to hear from you on LinkedIn.

With thanks to Stirling Bookallil, David Regan and Sarah Martin for their research and contributions to this article.