It might take you a second to remember what life was like prior to COVID-19. Travel was booming, people were vacationing around the world, and the hospitality sector was flourishing. In 2019 alone, direct spending by resident and domestic travelers in the United States was around $3.1 billion per day, supporting a total of 15.8 million American jobs. If you dive into lodging specifically, around $242 billion was spent that year. To say the least, 2019 was an outstanding year in the hospitality sector.Then, a Curveball

No one saw a disrupter like COVID-19 coming, and it’s safe to say the hospitality sector took one of the hardest hits. In a matter of months, far fewer beds were being filled at hotels across the US due to the many shutdowns. Average occupancy was around 44%, down 66% from 2019, resulting in significant loss of revenue. Another factor was the drop in the number of people flying. Globally, air traffic plummeted from 4.5 billion passengers in 2019 to 1.8 billion in 2020, resulting in a financial loss of $370 billion. The economic hit not only impacted hotels and airlines, but also food services, public transportation, and retail.

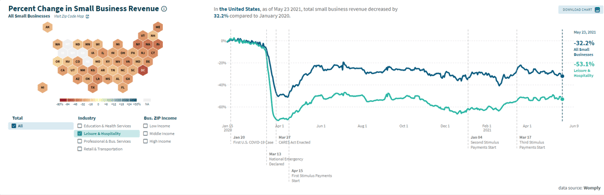

The chart below shows the pandemic’s effect on the leisure and hospitality sector, highlighting the historical changes that took place from 2020 to now. According to this chart, “In the United States, as of May 23, 2021, leisure and hospitality small business revenue decreased by 32.2% compared to January 2020.”

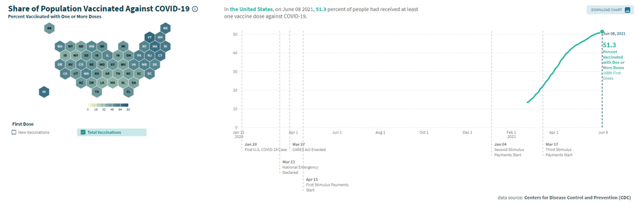

Fast forward through what felt like the longest year on record and here we are halfway through 2021. Americans are starting to see the light as vaccines are steadily distributed across the nation and states continue to open. Consider the chart below. As of June 8, 2021, around 51% of the US population has received at least one dose of the vaccine. As this number increases, travelers are becoming comfortable again with the idea of taking a trip.

Travel Pulse recently conducted a survey of over 5,800 travelers and a key finding was that “61% feel hopeful about travel in 2021, of whom 83% will take two or more domestic trips and 44% plan for two or more international getaways.”

What does this mean for the hospitality sector? As Americans feel more comfortable with traveling, the hospitality sector will begin to recover. Restaurants, lodging, and retail will see sales increases. (US restaurant sales are expected to increase by 11% in 2021, still far behind 2019 but improving since 2020.)

Another component of recovery is the American Rescue Plan. Around $5.3 trillion has been pushed out from the federal government through six major bills to help mitigate the burden on families and small businesses, which we know are the heart of our economy. Financial institutions have played an instrumental role in the Paycheck Protection Program and CARES Act, providing loans to small businesses to ensure they can keep their doors open and their employees compensated.

As we continue to see the vaccine distributed and states reopen, it may be worth your time to revisit the hospitality sector. A challenge that many financial institutions have faced in the past year is the need to deploy their assets towards loan growth. Jack Henry has a digital Loan Marketplace for banks and credit unions to buy, sell, and participate loans from all asset classes. The time is right to begin exploring post-COVID opportunities for growth in the hospitality sector and beyond.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are