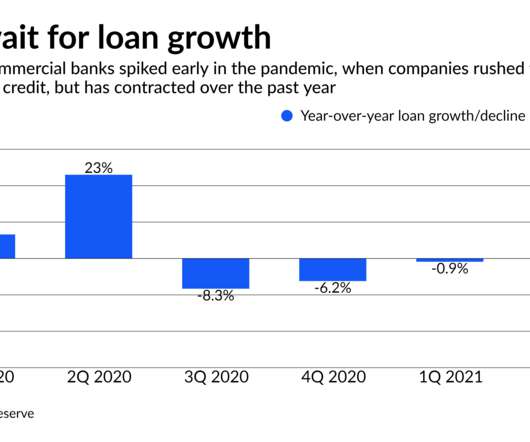

Spotlight on Loan Growth — or Lack of it — as Earnings Season Kicks Off

American Banker

JULY 12, 2021

Consumer lending Earnings Commercial lending Credit quality

American Banker

JULY 12, 2021

Consumer lending Earnings Commercial lending Credit quality

Accenture

JULY 11, 2021

Auto and equipment buyers are no longer satisfied with simply financing an asset, the traditional way of paying for such things. Instead, they want maintenance and service included, and they expect more flexible payment plans.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

JULY 16, 2021

FinCEN Releases 8 AML/CFT Priorities These priorities were published June 30, 2021, highlighting several areas of heightened risk for the U.S. financial system. Would you like others articles like this in your inbox? Takeaway 1 FinCEN published its first list of priorities for AML/CFT policy, as required by the Anti-Money Laundering Act of 2020 (AMLA).

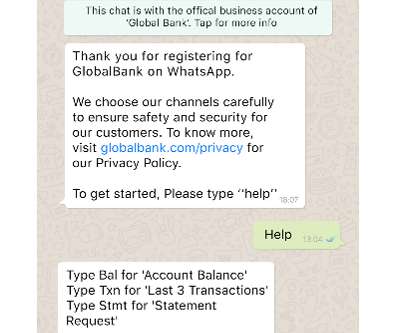

Cisco

JULY 12, 2021

Earlier this year Cisco completed its acquisition of imimobile, adding an enterprise-grade CPaaS platform to Cisco’s industry-leading collaboration and contact center solution portfolio. The Cisco Financial Services team welcomes imimobile’s Alex Cambell , SVP Sales at imi mobile, as our guest blogger this week. Changing consumer behavior and digital disruptors within the banking industry have redefined how we interact with financial service providers.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

SWBC's LenderHub

JULY 13, 2021

A funny thing happened on the way to the great reflation trade that, just a few weeks ago, was the dominant market theme. The reflation trade was supposed to get out in front of strong inflationary pressures as well as the sooner-than-expected withdrawal of some of the Fed’s extraordinary monetary policy support. The yield curve was supposed to steepen, with long-term rates like the 10-year Treasury note going through two percent for the first time since early 2019.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Abrigo

JULY 12, 2021

Q Factors under CECL and How They Will Compare Understanding the quantitative side of the CECL calculation is the start to applying qualitative adjustments under CECL. Would you like other articles on CECL and Q Factors in your inbox? Takeaway 1 Banks and credit unions moving to CECL in 2023 understandably want to know how Q factors will compare with current practices.

ATM Marketplace

JULY 16, 2021

Between COVID-19 closing down bank branches, and changing customer expectations, it can be a challenge for financial institutions, independent ATM providers and other companies to strategize their path forward. The Bank Customer Experience Summit, held on Sept. 13-15 in Chicago, will provide crucial guidance.

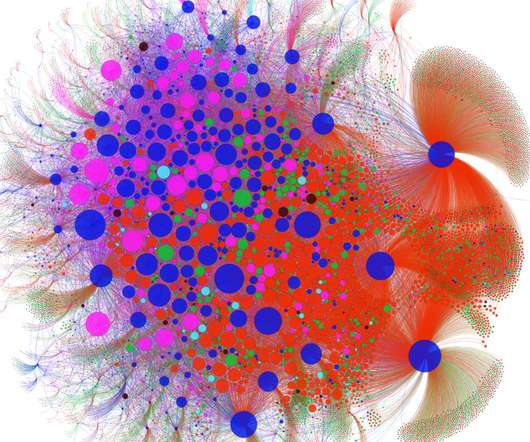

BankUnderground

JULY 12, 2021

Giovanni Covi, Mattia Montagna and Gabriele Torri. Systemic risk in the bank sector is often associated with long periods of economic downturn and large social costs. In a new paper , we develop a microstructural contagion model to disentangle and quantify the different sources of systemic risk for the euro-area banking system. Calibrated to granular euro-area data, we estimate that the probability of a systemic banking crisis was around 3.6% in 2018.

TheGuardian

JULY 14, 2021

When Doug Fishbone came across an abandoned apartment complex in Cork, he decided to recreate it in a gallery – to highlight everything that’s wrong with our property-fuelled financial system A grim concrete wall greets visitors to the Crawford Art Gallery in Cork. It fills the full height of the space, hemmed in by a corrugated steel fence. You might think you’d walked into a room still under construction – until you notice the street lamp.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Abrigo

JULY 12, 2021

The Financial Action Task Force (FATF) addressed areas of AML global concern. The agency recently completed their three-day June plenary. They addressed some of the most pressing illicit financial issues the world faces today. . Would you like others articles like this in your inbox? Takeaway 1 Following the three-day plenary, FATF released expanded guidance in several areas of AML/CFT global conerns.

ATM Marketplace

JULY 13, 2021

ATMs went through a challenging year in 2020, but as the industry comes out of the pandemic, a question emerges: What's on the horizon?

BankUnderground

JULY 16, 2021

J ames Hurley, Sudipto Karmakar, Elena Markoska, Eryk Walczak and Danny Walker. Compass on old map. This post is the second of a series of posts about the Covid-19 pandemic and its impact on business activity. Covid-19 led to a sharp reduction in economic activity in the UK. As the shock was playing out, small and medium-sized businesses (SMEs) were expected to be more exposed than larger businesses.

Qudos Bank

JULY 11, 2021

During summer there can be many temptations to spend more than you're mean to – Christmas gifts, summer holidays, days out with friends and family enjoying the weather.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

BankInovation

JULY 16, 2021

U.K.-based neobanks, otherwise known as “challenger banks,” continued to court investors with significant funding rounds this week. London-based company Revolut may now be the most valuable fintech in the U.K. and one of the most valuable fintech startups in Europe. Bank Automation News looks at this week’s highlights. Revolut Neobank Revolut on Thursday announced a […].

MerhantsBanks

JULY 16, 2021

Tirzah Warren has been promoted to Assistant Vice President/Teller Administrator at Merchants Bank, according to Sue Hovell, Director of Retail Banking Performance. “Over her 20-year career, Tirzah has consistently demonstrated her commitment to serving our customers and her leadership ensures they are taken care of professionally and compassionately by our teller team,” said Hovell.

FICO

JULY 15, 2021

A core pillar of promoting and sustaining widespread access to credit is ensuring high levels of financial literacy. Unfortunately, the U.S. lags behind many other countries in financial literacy, meaning millions of Americans lack the resources they need to chart a healthier financial future. But thanks to nonprofit organizations like Operation HOPE — which collaborates with financial institutions, corporations, municipal agencies, and community organizations to help low- and mid-income America

ABA Community Banking

JULY 13, 2021

With more than 100 institutions now offering Bank On-certified checking accounts—and more in the pipeline—what can banks of all sizes learn from the experience of their certified peers? The post Raising the Standard appeared first on ABA Banking Journal.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

BankInovation

JULY 16, 2021

Fifth Third Bank is migrating from a custom-core legacy system to FIS Modern Banking Platform, a managed-as-a-service core banking solution, the companies announced earlier this week. The migration will allow the $203.8 billion bank to reduce its development time and deploy new products to weeks, rather than months, Ed Loyd, Fifth Third director of public […].

Qudos Bank

JULY 11, 2021

When you’re looking for a new home, it’s unlikely that you end up buying the very first one you see. Instead, most people attend a few open homes to learn about the local market and understand what good value looks like, before making their purchase decision. Choosing your home loan should be the same - shopping around and comparing your options before you apply can help you find a better deal and save you serious money in the long run.

CFPB Monitor

JULY 15, 2021

The Federal Reserve, FDIC, and OCC have released proposed guidance for banking organizations on managing risks associated with third-party relationships, including relationships with financial technology-focused entities such as bank/fintech sponsorship arrangements. Comments on the proposal will be due no later than 60 days after the date it is published in the Federal Register.

Jack Henry

JULY 15, 2021

While the cruise industry has seen better days, like many other sectors, it’s poised for a strong comeback based on pent-up demand and untapped travel budgets carried over from 2020. And as a former Coast Guard licensed riverboat pilot and 30+ year veteran of the financial services industry, I was recently pondering the similarities between financial technology and cruise ships.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

BankInovation

JULY 16, 2021

In this week’s episode of “The Buzz,”?Bank Automation News?discusses the growing presence of Erica-based capabilities at Bank of America. A virtual assistant powered by artificial intelligence, Erica has graduated from dealing with customer enquiries to assisting financial advisors at Bank of America’s Merrill Lynch division. The $3.02 trillion financial institution has also been using (AI) […].

SWBC's LenderHub

JULY 12, 2021

When the COVID-19 pandemic hit in March 2020, millions of Americans had to adjust to statewide shutdowns that lasted for months. During that time, we adapted to living entirely different lives, and digital technology provided many of the solutions that made that possible.

CFPB Monitor

JULY 15, 2021

The CFPB announced earlier this week that it has issued a consent order against GreenSky, LLC that finds GreenSky engaged in unfair acts and practices in connection with its origination and servicing activities related to its point-of-sale financing program. The consent order requires GreenSky to refund or cancel up to $9 million in point-of-sale loans and pay a $2.5 million civil penalty.

ATM Marketplace

JULY 14, 2021

In this webinar, Stratifyd’s Kurt Trauth, SVP of Customer Experience Strategy and Analytics, will share with you the unexpected best practices that he’s discovered in his time as USAA’s Voice of the Customer leader and in his role at Stratifyd working with top financial institutions.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

Let's personalize your content