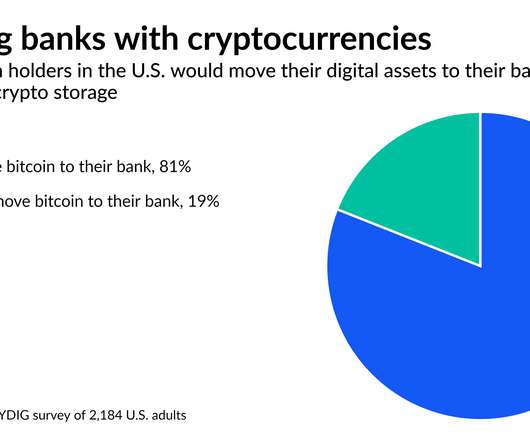

Playing Catch-Up in Crypto, Banks Ask Core Providers for Help

American Banker

JUNE 14, 2021

Core systems Bitcoin Digital transformation - The Simplification of the Tech Stack Cryptocurrencies

American Banker

JUNE 14, 2021

Core systems Bitcoin Digital transformation - The Simplification of the Tech Stack Cryptocurrencies

ATM Marketplace

JUNE 15, 2021

Banks are rushing to create better branch experiences in the wake of changing customer expectations post pandemic. But how can they make the transformation successful? Here are a few trends to keep in mind to help with that

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Cisco

JUNE 14, 2021

Earlier this year Cisco completed its acquisition of imimobile, adding an enterprise-grade CPaaS platform to Cisco’s industry-leading collaboration and contact center solution portfolio. The Cisco Financial Services team welcomes imimobile’s Jay Patel – VP & CEO of imimobile as our guest blogger this week.

Abrigo

JUNE 14, 2021

Create an effective sanctions program Considering the current economic and political environment, it is crucial that financial institutions maintain a strong sanctions compliance program (SCP). Would you like others articles like this in your inbox? Takeaway 1 OFAC has issued new guidance on the essential components of a strong compliance program. Takeaway 2 Financial institutions must train front-line staff to identify behavioral red flags that could indicate elder financial abuse.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Accenture

JUNE 18, 2021

Banking’s push to digital during the pandemic has placed tech in the spotlight. The power of the cloud has never been so clear. Accenture research shows that 49% of banks have moved a significant portion of their workloads to the cloud, compared with 33% of businesses across all industries. It’s safe to say that nearly…. The post People will help banks win the race to the cloud appeared first on Accenture Banking Blog.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

SWBC's LenderHub

JUNE 17, 2021

The municipal bond market took a wild ride in the first half of the year to near-historic levels of richness versus Treasuries that is rarely seen, and the environment is ripe for the second half of the year to take it even further. The outperformance of municipals in the first half can be attributed to many factors, such as inflation, rising tax rates and an imbalance of supply and demand.

ATM Marketplace

JUNE 18, 2021

Customers' expectations have changed dramatically these past few years. They now expect seamless experiences across all channels. Can your ATM keep up with this demand?

Accenture

JUNE 14, 2021

The Efma-Accenture Banking Innovation Awards have been a catalyst for innovation in banking since their inception in 2013. Since then, I look forward to them every year as the industry rewards and celebrates innovation. After a pause in 2020 due to COVID-19, this year’s ceremony brings even more anticipation. I have discussed Growth Markets and…. The post Setting the stage for the best banking innovations of 2021 appeared first on Accenture Banking Blog.

BankUnderground

JUNE 16, 2021

Catherine R. Schenk. In partnership with the Data Analytics for Finance and Macro Research Centre at King’s Business School and the Qatar Centre for Global Banking and Finance at King’s Business School, the Bank of England organised a ‘ History and Policy Making Conference ‘ in late 2020. This post contributes to our occasional series of guest posts by external researchers who presented their research at this conference.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

SWBC's LenderHub

JUNE 14, 2021

Last Week: Treasury yields were front and center last week as equities and corporate bonds quietly ground higher and tighter. All through last week, longer-dated Treasury notes and bonds rallied and the yield curve flattened 11 basis points despite large funding operations and the May CPI coming out higher than expected. The reasons for the rally sit squarely with the flow of funds.

Jack Henry

JUNE 17, 2021

To say we’re living in unprecedented times would be an understatement. Thanks to a global pandemic, it seems like just about everything has changed, from social norms to travel to where and how we work. While we’re not out of the woods yet, we do seem to be settling into new ways: a post-pandemic world, if you will. And thanks to the latest technology, many businesses, including banks and credit unions, have the tools to adapt and even thrive in a remote world.

Banking Exchange

JUNE 14, 2021

Bank of America ranks highest in banking mobile app satisfaction, reports JD Power Retail Banking Feature Lines of Business Technology Mobile Online Tech Management Feature3 Community Banking Consumer Compliance Customers.

ATM Marketplace

JUNE 16, 2021

Go beyond surveys to build a modern CX strategy. Stratifyd for CX and Voice of the Customer is designed for the business you have today and the changes of tomorrow. With so much changing, don’t get caught flat-footed thanks to legacy technology and static dashboards that don’t grow along with you. Read this eBook to learn more.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

TheGuardian

JUNE 18, 2021

Accounting firm embraces ultra-flexible working with staff able to choose if they come into the office at all Deloitte will allow its 20,000 UK employees to choose how often they come into the office, if at all, after the pandemic, making it the latest firm to throw out the rulebook and embrace ultra-flexible working. The accounting firm said it would let staff decide “when, where and how they work” following the success of remote working during the Covid crisis.

BankInovation

JUNE 18, 2021

A Swedish hedge fund that returned roughly four times the industry average last year using artificial intelligence won’t touch Bitcoin, based on an assessment that the cryptocurrency doesn’t lend itself to sensible analysis. Patrik Safvenblad, the chief investment officer of Volt Capital Management AB, says the problem with Bitcoin and other crypto assets is that […].

Qudos Bank

JUNE 15, 2021

Most people have been surprised by an unexpected bill before, whether it’s an expensive car repair or a higher-than-expected energy bill during a hot Summer. If you haven’t planned for them, these costs can easily sneak up on you and cause a financial headache.

FICO

JUNE 15, 2021

It’s June, a special month for honoring loved ones, especially parents and grandparents by raising Elder Abuse Awareness. World Elder Abuse Awareness Day is officially June 15th and it’s an ideal time to educate oneself on how to protect elders from becoming victims of financial abuse. All too often, elders today are the targets of residential real estate fraud and scams.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

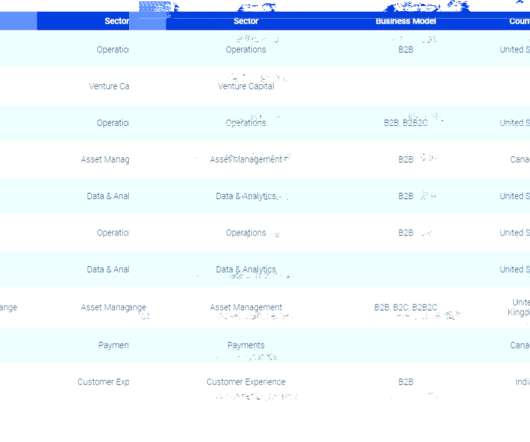

CB Insights

JUNE 17, 2021

The adoption of fintech apps has skyrocketed throughout the Covid-19 pandemic, spurring further growth and investor interest in this category. Fintech had one of the most successful quarters in history in Q1’21 , with record deals, funding, exits, and mega-rounds. . Eager to turn the ongoing fintech boom into an advantage, big tech companies (Facebook, Apple, Google, Amazon) have been taking a number of strategic steps to grow their market share in financial services.

BankInovation

JUNE 17, 2021

The design of a potential U.S. central bank digital currency (CBDC) remains a topic of debate, as made clear at a Tuesday hearing of the U.S. House Committee on Financial Services?Task Force on Financial Technology. Witnesses at the virtual hearing discussed the need for a CBDC and noted the automation possibilities that might accompany a digital dollar issued by the Federal Reserve.

Banking Exchange

JUNE 14, 2021

BMO Harris Bank’s new premises will cater for mid-market businesses, while Citizens Bank purchases West Virginia branches Community Banking Feature3 Feature Management M&A.

CFPB Monitor

JUNE 17, 2021

The D.C. federal district court hearing the lawsuit filed by the Conference of State Bank Supervisors (CSBS) seeking to block the Office of the Comptroller of the Currency from granting a national bank charter to Figure Technologies Inc. has entered an order staying the lawsuit. On June 15, CSBS filed an Unopposed Motion to Stay Litigation in which it referenced Acting Comptroller Hsu’s testimony to the House Financial Services Committee last month in which he indicated that the OCC is currentl

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

SWBC's LenderHub

JUNE 14, 2021

If you haven’t noticed, the era of in-person transactions is fading in the rearview mirror of a society that has recently weathered its first global pandemic. Today, thanks to the internet, smartphones, and other digital technology, commerce can occur anywhere at any time—usually with just a few clicks.

BankInovation

JUNE 17, 2021

Banking application Dave announced its plan to go public via a special purpose acquisition merger last week, a transaction that values the neobank at $4 billion. But while the app touts overdraft fee avoidance as its flagship feature, it’s unclear whether this is enough to make customers switch accounts. Backed by investors like Tiger Global […].

Banking Exchange

JUNE 16, 2021

Mississippi-headquartered BancorpSouth Bank has joined the growing number of banks calling on external consultancies to assist with its handing of current expected credit loss (CECL) rules Compliance The Economy Feature Risk Management Feature3.

CFPB Monitor

JUNE 17, 2021

State legislatures in New Mexico and Nevada enacted laws this session targeting medical debt collections. Both laws have been signed by the states’ Governors and take effect July 1, 2021. New Mexico Patients Debt Collection Practices Act . The New Mexico Patients Debt Collection Practices Act places a number of requirements on health care facilities and debt collectors and buyers.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

Let's personalize your content