Other parts of this series:

There are times when you have to break something apart in order to make it better. For banks, it’s time to break down the traditional value chain and replace it with a more future-friendly set of business models. Until now, the value chain in banking has relied on a vertically integrated business model. But in a world where financial products are embedded and invisible within non-banking partners’ offerings, and customers are increasingly doing business over their smart phone (or even their watch), those old models are being shattered by new digital-only players that are seizing the fragments and turning them into profits.

In our report on the Future of Banking, we identify two key concepts that are at work in this new, non-linear ecosystem:

Product componentization: Today’s traditional banking products get broken down into components—new micro-products and services that may be sold separately or in re-bundled versions.

Value chain fragmentation: The layers in the value chain—from product manufacturing and proposition packaging to sales and distribution—become uncoupled. Instead of the bank owning the entire chain, different parties own different layers.

As I mentioned in my first post in this series, digital challengers are taking advantage of these concepts to chip away at incumbent banks’ business.

The future is fragmented

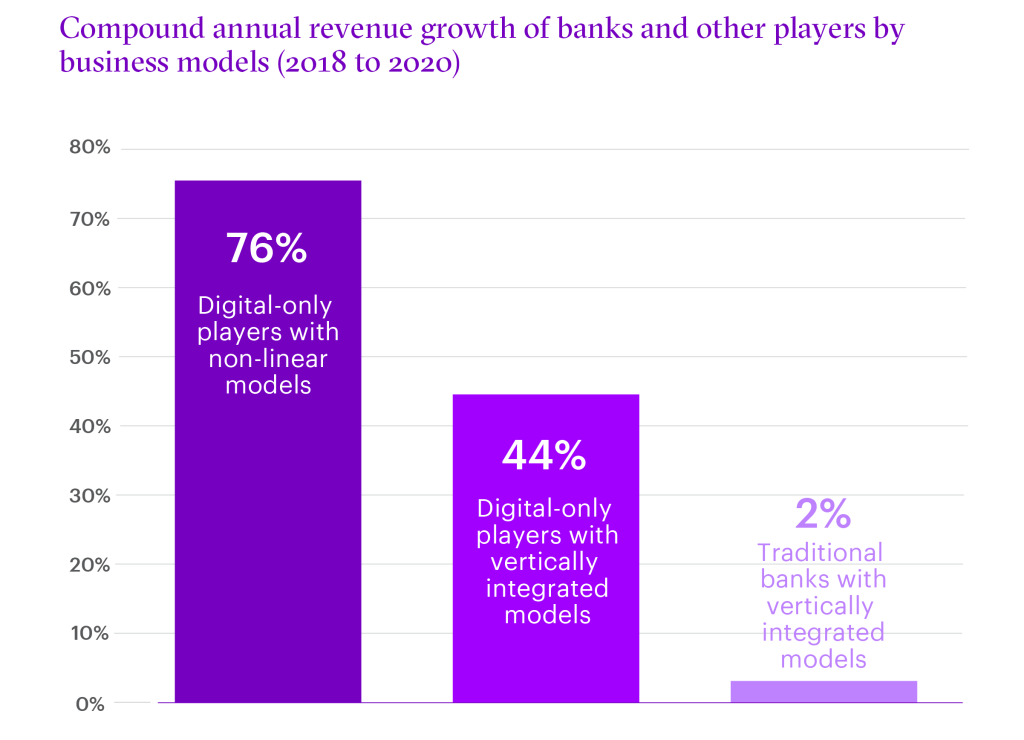

Digital-only players that adopt these non-linear business models are outperforming competitors that simply employ vertically integrated models in the digital world. Both are growing much faster than traditional banks, although in most cases this is off a smaller base.

To add to the pressure, incumbent banks are now facing competition from a more diverse group than just digital-only banking challengers. Recently, there has been an acceleration in the growth of so-called “super-apps.” These multi-offering platforms are more than simply marketplaces: they own the customer, they own the experience and they redefine the value propositions. As users spend an ever-increasing amount of time on these super-apps and do more kinds of business through them, incumbent banks ignore this shift at their peril.

All of these new, non-linear players have certain things in common: they have focused on the customer’s intent, decoupled themselves from the traditional value chain and embedded their services into the right place and time in the customer journey. As a result, their business models enable them to scale with lower customer acquisition costs.

By singling out the specific layers of the banking value chain—and the micro-product niches—in which they choose to play, non-linear digital competitors have configured innovative products and propositions fast and at low cost. Since they don’t try to own the entire value chain, they have the flexibility to rapidly create new models and differentiated products that maximize the value they can capture. They focus on offering targeted products that a digital customer might search for online. Customers can then draw on the offerings of several unrelated providers to create custom bundles that meet their specific needs.

There are opportunities for value and growth for players that adapt to this fragmented value chain by either embedding their products or acting as a super-app and aggregating them with the products of other players.

The future of banking: Time to rethink business models. An Accenture report outlines new banking business models that enable banks to reconfigure themselves to keep pace with disruption.

LEARN MOREBanks can also play in the digital marketplace

With the fragmented value chain model, financial services providers are uncoupling customer experience, distribution, product manufacturing and balance sheet management. Traditional products are being broken into smaller components that can be marketed separately. Incumbent banks can also embrace this approach to create new niche products and services for the digital marketplace and compete head-to-head with digital-only challengers.

92% of banking executives say that to succeed in the future they are willing to operate more like broad federations of businesses in response to market fragmentation.

– Accenture Signals of Business Change: Business Futures Survey 2021

By breaking down the traditional value chain and reconfiguring its parts to offer better customer propositions, incumbent banks can unlock a multitude of new growth opportunities. But unbundling products into components and playing new roles at multiple levels of a delayered value chain will demand a new approach from banks that includes:

- A clear strategy;

- An adaptive business model;

- Advanced, intent-driven use of data, rather generic use focused on the customer journey;

- A robust technology architecture coupled with intelligent operations; and

- The ability to manage multiple business models in a portfolio.

Value-chain fragmentation and componentization are challenging banks’ business models, but also creating opportunities to roll out innovative ideas and products, differentiate from the competition and expand their vision of what a bank can be. There is a hidden opportunity for incumbents, driven by new options for pricing their product components. Banks that embrace this approach have a chance to create exponential value without carrying the cost of owning the whole value chain.

In the next post in this series, I’ll be looking at the future of banking business models. That’s models—plural—because as banking evolves through the next decade, one business model will not be enough.

To discover how your bank can start getting more value from your componentized products and services, contact me. To learn more about the Future of Banking, read the full report, “It’s time for a change of perspective”.

Read report