Setting Loan Maturity – Use This Trick To Better Compete

Community banks refine their products and services to compete for better borrowing relationships – the better borrowing relationships are associated with better credit quality, meaningful cross-sell opportunities, acceptable margins and fee income, and higher return on equity (ROE). Unfortunately, current market dynamics are making it hard for community banks to outcompete for these better borrowing relationships. The current shape of the yield curve is undermining some community banks’ loan products and lowering service levels to borrowers. The tough part is these banks are largely unaware that this is happening.

How The Interest Rate Environment Impacts Loan Maturity

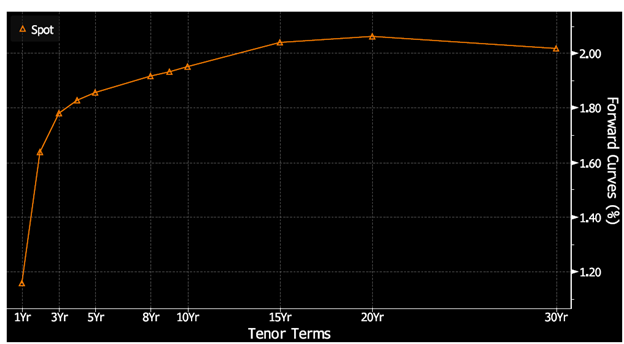

The current US yield curve is flat between three and 30 years. The graph below shows hedge rates from one to 30 years (Treasury rates show a similar flat curve).

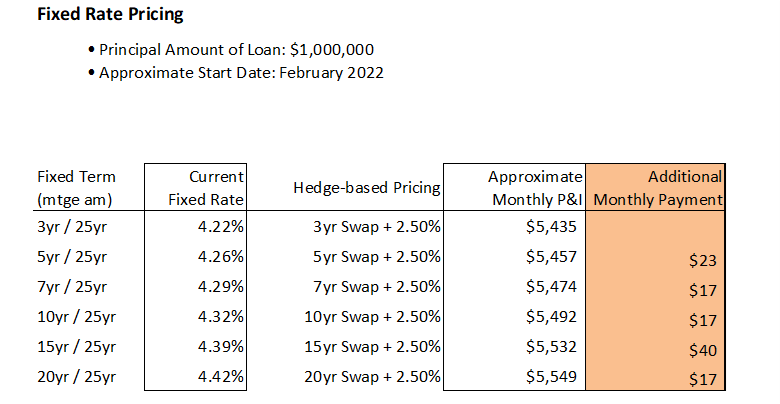

The table below shows the prevailing interest rate and P&I payment using a 25-year amortization schedule for a $1mm loan for three years out to 20 years. Each fixed rate option is priced using the same margin over the yield curve and represents how banks are currently pricing their better borrowers.

The table above shows the minimal difference in interest rates between three-year term loans and longer-term loans out to 20 years. However, the real cost of the loan to the borrower is the monthly P&I payment, and the additional payment for each longer term is shown in the highlighted column on the far right. The term premium on a $1mm loan from three years out to 20 years is insignificant.

Why Banks Should Take Notice

Banks that can offer competitively priced commercial loans for fixed-rate terms in the 10 to 20-year range will have a competitive advantage for three critical reasons. First, these banks will be able to differentiate their product from most competitors. Second, these banks will be able to offer a higher level of service. Third, the longer-term fixed rates give banks the ability to transition from transaction lending to relationship banking.

Using Loan Maturity as Differentiation

Many lenders in the market readily offer commercial fixed-rate loans for up to five years. But fewer banks are able to offer 10, 15, or 20 year fixed rate commercial loans. Competing against fewer lenders is a tremendous advantage for community banks. In today’s market, winning a commercial loan using a five-year fixed rate option requires concession on pricing or credit structure – neither is a good option for long-term success. In a flat yield curve, offering longer fixed-rate commitments at similar costs is a significant competitive advantage.

Setting Loan Maturity and Service

Bankers want to be viewed by clients as trusted advisors who help borrowers perform well. This involves matching banking products and services to the client’s needs and expectations. As an industry, we can no longer say that we provide a high level of service and turn customers away from requesting long-term fixed-rate term loans. Most national and regional banks are already offering such solutions. To provide superior service, community banks must accommodate reasonable borrower requests. Community banks that help borrowers succeed by providing long-term financing and eliminating the borrowers’ refinancing risk for 10, 15, or 20 years can help improve the borrower’s financial performance and help customers succeed in their business – this would further distinguish a bank from its competition.

Setting Loan Maturity For A Longer Customer Lifetime Value

Most community banks value relationship banking over transactional banking. Community banks can foster relationship business through products, geography, service level, or expertise. A five-year fixed-rate loan has an expected life of only two to three years. This creates transactional expectations from the borrower – every few years, the borrower and the banker expect the community bank to compete for that same financing needs.

Each competitive situation potentially requires that the bank again competes on pricing or credit structure. However, a 10, 15, or even 20 years fixed rate commitment has a much longer expected life. Longer commitments increase the lifetime value of the relationship and eliminate repetitive competitive situations. The longer life also allows the bank to cross-sell more products and further solidify the customer relationship. Community banks that value relationship banking should be able to offer longer-term commitments.

Conclusion

We have some recommendations for banks that may be applicable in the current and expected interest rate environment. Next week, we will consider what the market is projecting for interest and credit risk. We will also discuss products available to community banks to take advantage of a flattening yield curve, mitigate credit risk, differentiate from market competitors, and increase the lifetime value of a loan.