A Future-Ready Approach: Journey to the Cloud

Accenture

APRIL 7, 2021

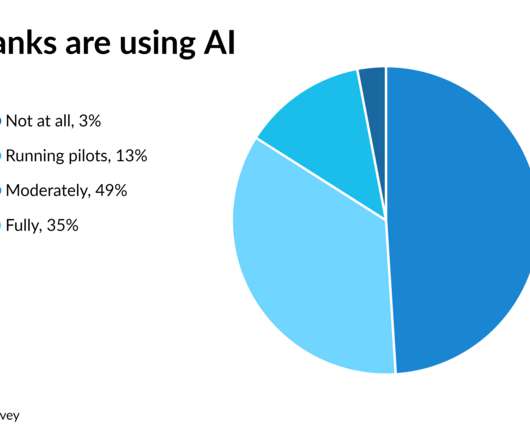

This series of blogs looks at the future of banking in Growth Markets in a post-COVID-19 world. Banks need a clear approach to eliminate their legacy technology debt and attain future-ready systems. That means taking the journey to the cloud – a typically incremental process by which banks shift their core-systems architecture to a flexible,….

Let's personalize your content