I wrote my blog about the bank branch being dead the other day, just as a new report called for banks to stop trying to be cashless and branchless because it harms society. This is from the RSA (Royal Society for the encouragement of Arts, Manufactures and Commerce), an association founded by William Shipley in 1754. It’s a fine and prestigious organisation that promotes the enrichment and enlightenment of society through new ideas and actions. Today, their near 30,000 fellows are engaged in all parts of social change, and so it is interesting when they focus upon banking and write a report about it.

In an update last week, they launched their report on the threat of a cashless and branchless society. Here’s the Executive Summary (read the full report, Cashing Out: The hidden costs and consequences of moving to a cashless society, on the RSA website).

Bank branches are disappearing fast from UK high streets and it is clear cash will continue to decline.

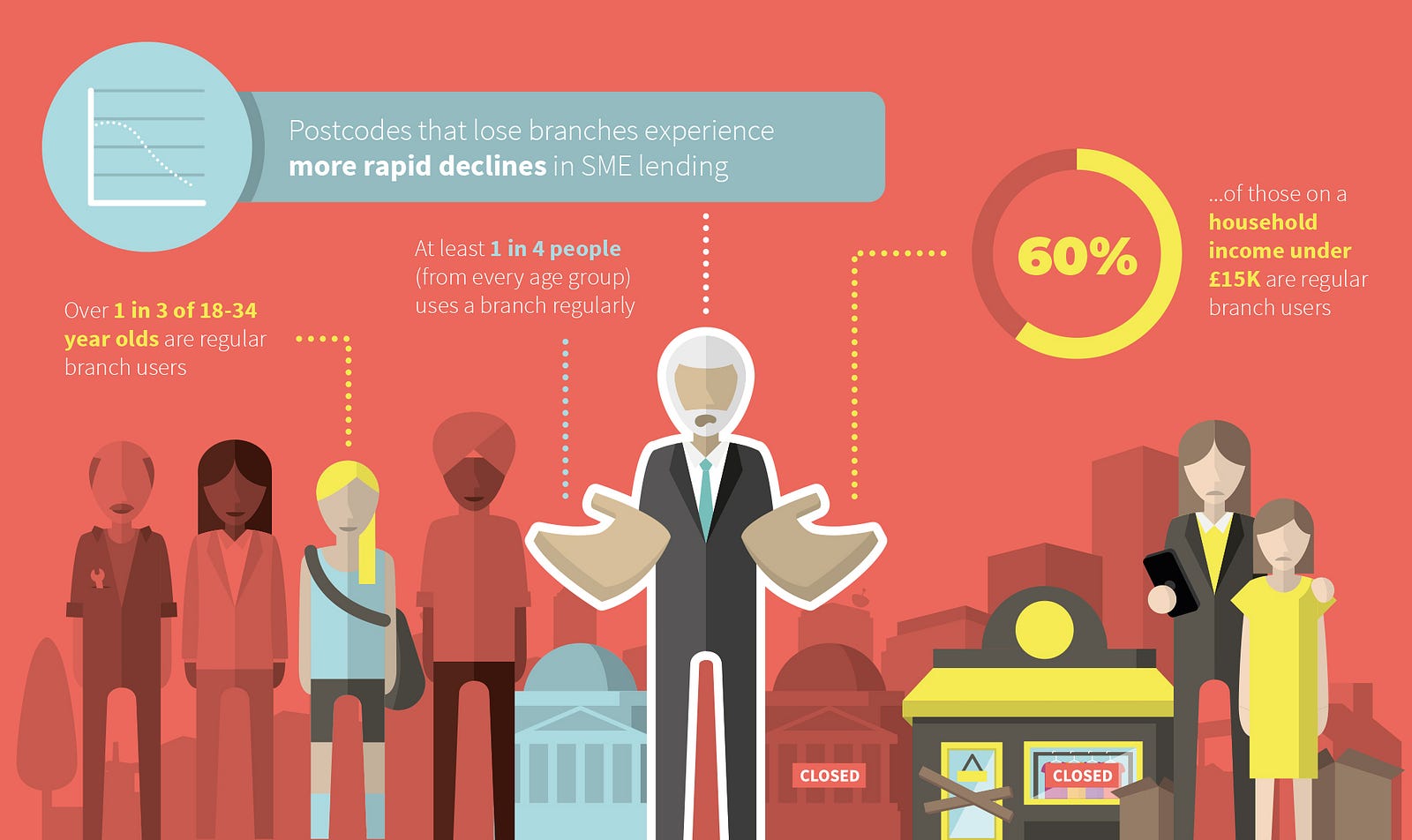

While this partly reflects the rise of the digital age, this report concludes that the UK banking industry’s disorderly dash from cash and the sharp reduction of branch networks is harming many communities and poses material economic and social risks, including to vulnerable consumers and smaller businesses. We also find evidence that branch closures damage and weaken our high streets, by reducing bank lending to small and medium sized businesses.

We need a coordinated strategy between regulators, incumbent banks, the post office and new niche challengers to ensure that the UK maintains a physical banking infrastructure capable of supporting economic resilience and inclusive growth. Improving diversity of banking provision and encouraging a coordinated evolution of the national branch network could address these problems

Key Findings

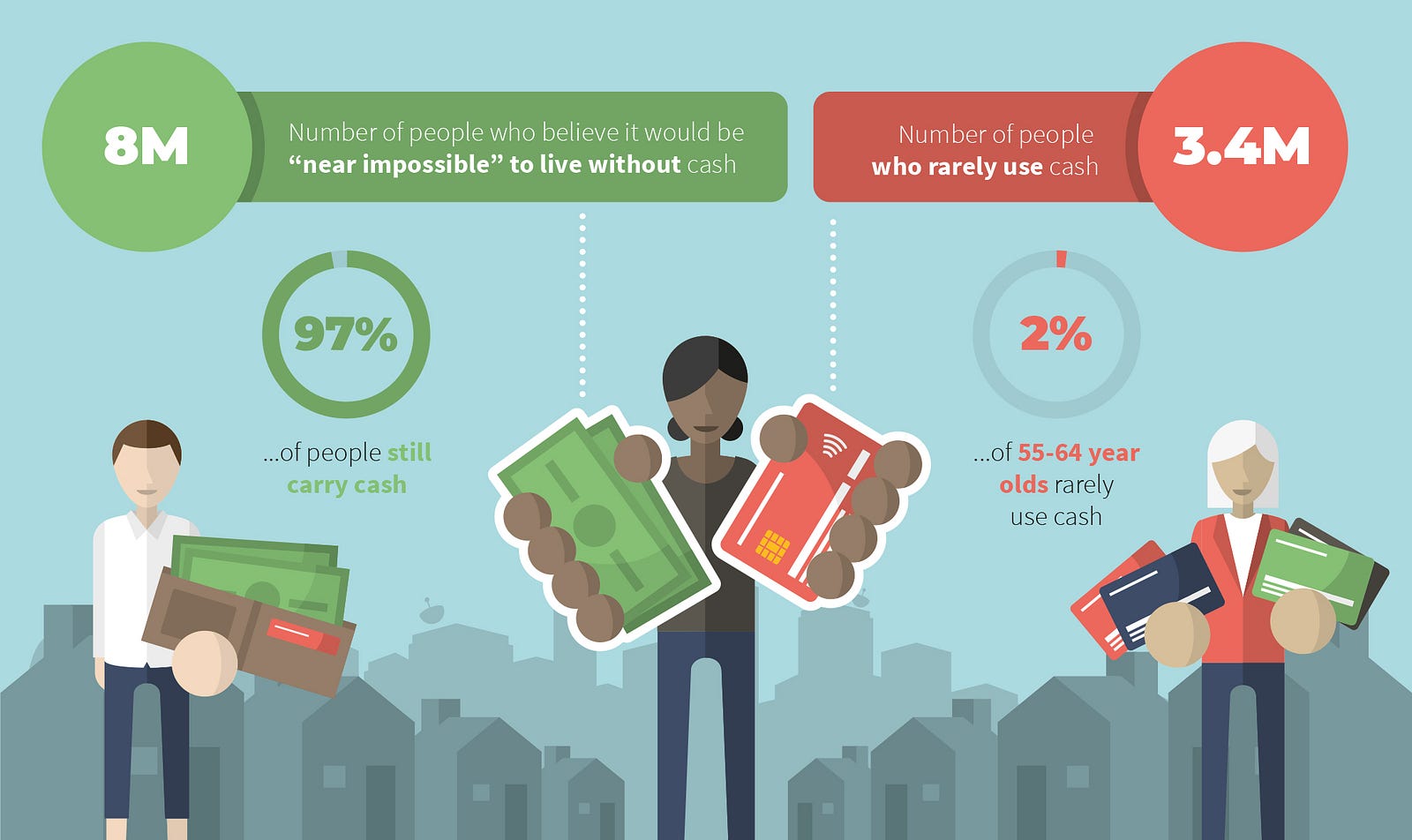

- Substantial numbers still rely heavily on cash: 3.4 million people in the UK rarely use cash, but 2.2 million people rely almost wholly on cash, up from only 1.6 million people in 2014. According to the Access to Cash Review, a much larger proportion of the population, some 8 million, would find life “near impossible” without cash.

- Branches are not just about older people: Over one in three of 18 to 34 year olds are regular branch users and 25 to 44 year olds are more likely to deposit cheques or cash face to face in a branch (28 percent) than those over 65 (24 percent).

- SMEs rely on branches for credit as well as cash: Branch closures appear to reduce SME lending and hence are likely to damage employment, productivity and growth. Smaller businesses in many sectors also require cash handling facilities and are suffering harm from branch closures.

Conclusions: four reasons to protect cash and bank branches

Supporting Local Economies and SMEs

Bank branches have a positive impact on local economies, high streets and small businesses, including being important for customer services and SME lending.

Providing Choice and Competition

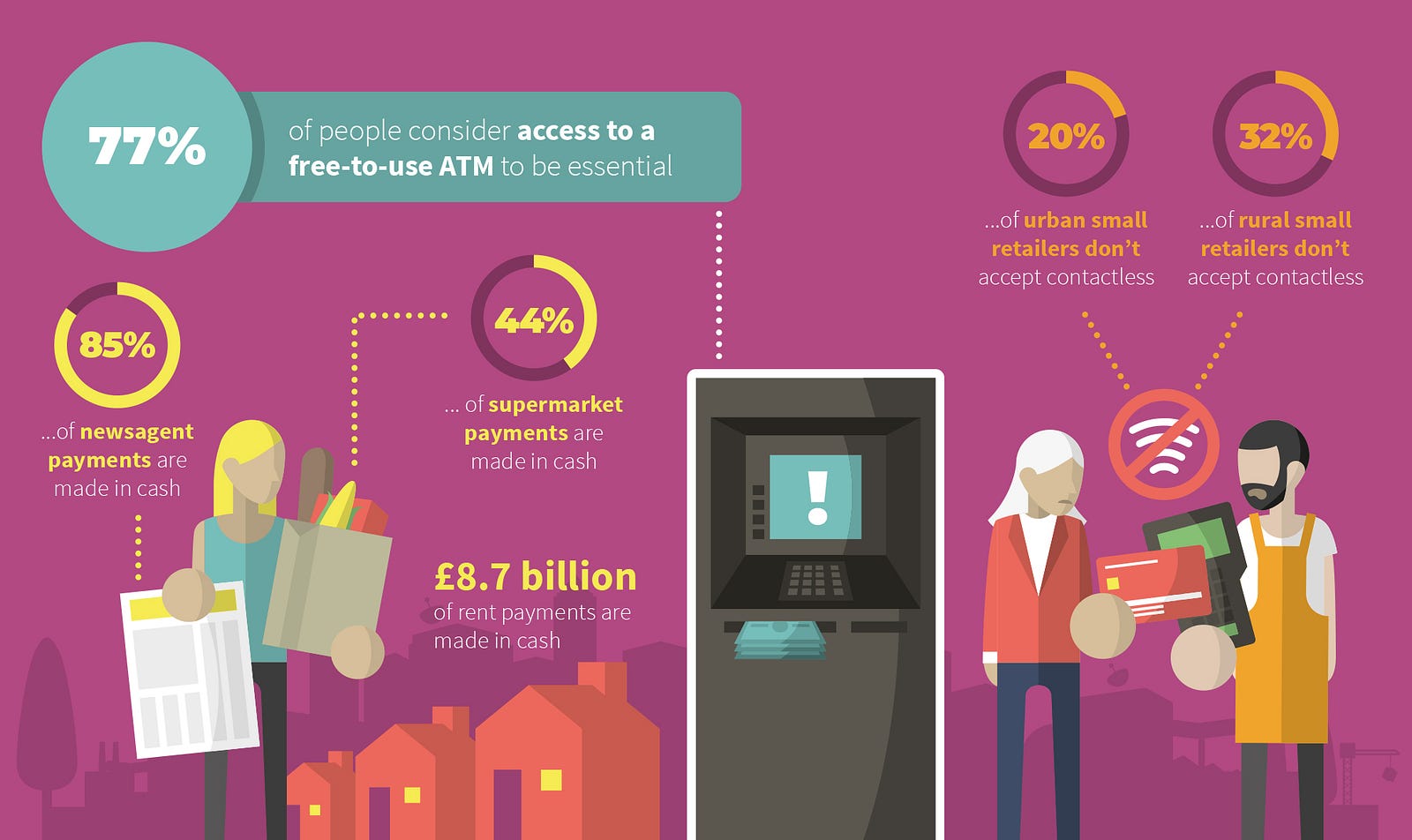

There are legitimate reasons for cash usage such as free universal access, simplicity, transparency, privacy and lack of digital access. It is the only way that citizens can directly access central bank money without intermediation by banks. Cash provides a restraint on fees and charges from the Visa/Mastercard duopoly.

Promoting Financial Inclusion

Cash is the only free means of payments available to the consumer with universal coverage. Phasing it out risks excluding vulnerable individuals and smaller businesses, especially in rural locations.

Boosting Economic Resilience

Cash insures against cyber risks and other network failures.

Recommendations

- Government commitment to maintaining a payment and savings system that is universal, free at the point of use and which protects personal privacy.

- The Financial Conduct Authority should conduct a review into the impact of bank branch closures on credit to SMEs, and consult on reforming disclosure of bank lending data.

- National strategy for universal access to cash and branches, developed using deliberative methods of public engagement to ensure a complete understanding of citizens’ needs, and considering measures such as guaranteed provision of free-to-use ATMs and a new moratoria on bank branch closures in places where no other branch exists.

- Regional strategies for diverse and inclusive banking that closely monitor cash and branch access while1 utilising physical resources to ensure suitable provision is maintained and this is publicised to citizens.

Read the full report, Cashing Out: The hidden costs and consequences of moving to a cashless society, on the RSA website.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...