Byte-7: Utilize your data via API to maximize the market presence

Perficient

FEBRUARY 19, 2021

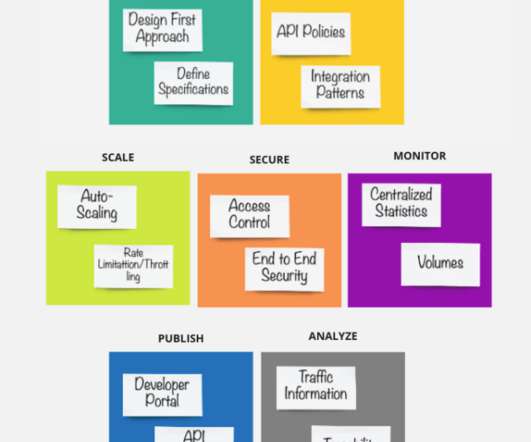

Today organizations are transforming to adapt to the new market needs and expand the business. Every organization is looking to maximize its value by utilizing the most incredible asset called data. Some organizations don’t have the scale to build everything independently, which drives the need for partnership with other organizations to maximize the market presence and offerings.

Let's personalize your content