To help lenders make loans to gig economy workers — those 57.3 million Americans who do some form of temporary work, such as part-time driving for Uber or freelancing — Blend has rolled out a service that automatically gathers and verifies income information.

San Francisco-based Blend, which provides mortgage and consumer loan software to 310 banks, has been working quietly to develop the service and already has 25 customers using it. The company said Wednesday that the service is now available to a wider range of clients.

Blend Income Verification pre-populates loan applications with verified payroll, tax, and asset data sourced directly from data service providers. The new service is an authorized report supplier for both Fannie Mae’s Desktop Underwriter validation service and Freddie Mac’s asset and income modeler and works with Blend’s mortgage software. The income verification tool will be integrated into Blend’s cloud banking platform, so the banks that use Blend in some way will have access to it.

Today, most lenders use a service like Equifax’s The Work Number to verify potential borrowers’ income. This new Blend service will not replace these, according to Blend CEO Nima Ghamsari, but augment it with data the current crop of income verifiers don’t have.

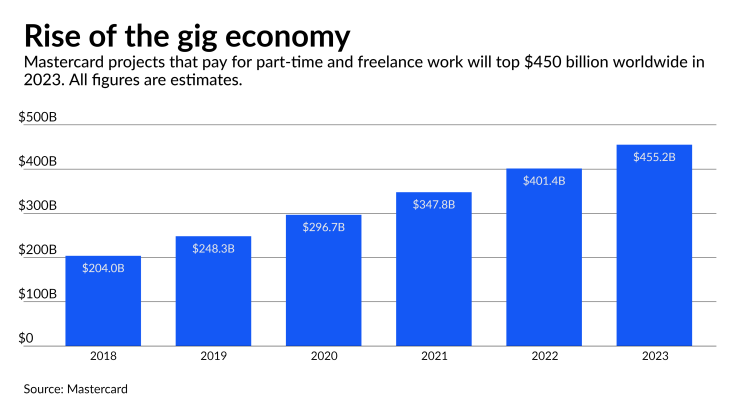

The number of gig workers has been growing steadily since 2017 and many expect that to continue. Mastercard estimates that the total volume of gig work pay will reach $455 billion globally by 2023.

“The Work Number is not going away,” Ghamsari said. “The Work Number is mostly for employers who report W-2 income.” Some payroll providers are not on The Work Number platform, he said, and gig economy workers and self-employed customers aren’t covered by such services.

The Blend service uses artificial intelligence to guide the income verification process, going through traditional sources like The Work Number first. If any of those fail to produce the needed data, it will ask the borrower for documents and draw information from those.

Blend also uses AI to extract data from the W-2 statements and tax returns customers provide. The accuracy of optical character recognition, technology that translates captured images from documents into text computers can read, has gotten so good, “you probably don't even want to have a human look at it because a human looking at it might be more likely to make a mistake over time,” Ghamsari said.

In instances where a potential borrower is a dog walker or other type of gig worker, Blend allows customers to connect their own bank account data to a loan application, and Blend will verify income based off of that, looking for recurring direct deposits that indicate some form of income. It will also draw data from gig economy companies that track workers’ income, such as Uber and Instacart.

“There is no homogeneous solution because the income sources for people like you and me are just vastly different over time,” Ghamsari said. “We will layer in more and more of these sources as they become available.” Blend uses multiple data aggregators to do this.

“No matter who you are as a consumer, what kind of job you have over time, we're going to find a way to verify you,” Ghamsari said.