Over the past year, we have witnessed an accelerated consumer adoption of digital banking, as consumers globally had to pivot from in-person banking to digital alternatives. Some financial institutions were prepared for this shift, while others had to quickly adjust to the ‘new reality’ of supporting consumers who wanted to manage their finances, pay bills, send money to family and friends, or simply deposit a check or open a new account.

The pandemic impacted all consumer segments. For instance, the digitally active consumer segments expanded beyond the young, to include those over 50. In fact, the largest growth in digital banking usage was with senior consumers, who have been the foundation of many smaller organizations. One of the most impacted areas of digital banking growth occurred with mobile deposits, with consumers in every demographic category depositing their stimulus checks using this functionality.

Finally, the importance of being able to quickly and easily open a new account or get a loan using online or mobile banking has become a significant differentiator between digitally mature organizations and those lagging the leaders.

In research done by the Digital Banking Report, while the future trends and priorities mentioned by all financial institutions were very similar, regardless of the size of organization, there was a significant disparity in the progress made to become a more mature digital provider of financial services based on asset size. The research found that many organizations under $10B will be challenged to match the digital banking capabilities of their larger peers.

Read More:

- 7 Essentials of Digital Banking Transformation Success

- How to Avoid Digital Transformation Failures in Banking

- Digital Transformation Requires More Than Technology Upgrades

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

2021 Retail Banking Trends and Priorities

Obviously, projections of 2020 retail banking trends and priorities did not take into account the impact of the global pandemic. In a matter of weeks, the way financial institutions delivered banking services changed because of the unprecedented shift to digital channels worldwide. This required organizations in all industries to alter their view of the future.

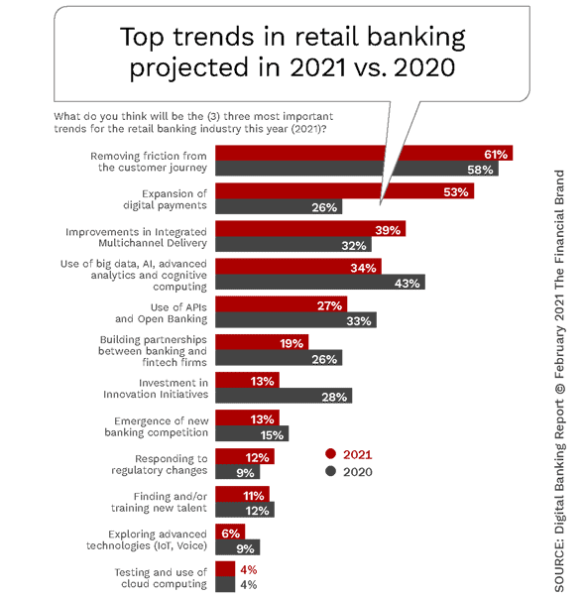

When the Digital Banking Report asked financial institution executives worldwide to provide their perspective of retail banking trends and priorities for 2021, there were some massive shifts reflecting the impact of COVID on the entire financial services industry.

The need to remove friction from the customer journey was viewed as a more important trend in 2021, as was the need to support digital payments as consumers stopped using cash. There was also a realization that integrated delivery of services across channels was an imperative that can’t be ignored.

Alternatively, financial institution executives believe there will be a drop in importance of several trends, including the use of data and advanced analytics, the importance of open banking, and the pursuit of fintech partnerships in 2021. There was also a significant drop in the belief that innovation will be a major trend this coming year. There was very little difference between big and small institutions in their perspective on trends for 2021.

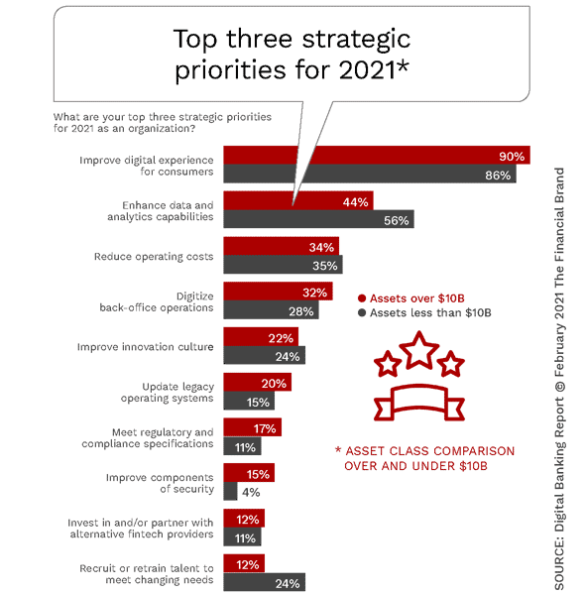

The top strategic priorities for 2021 were surprisingly consistent for big and small institutions as well, with the top three priorities being the need to improve the digital customer experience, a requirement to enhance data and analytic capabilities, and the desire to reduce operating costs. The difference between large and small organizations was most evident in the need to leverage data and analytics, with smaller institutions placing the priority higher (56% ranking as a top 3 priority) most likely because of a lack of focus on this priority in the past. Smaller firms also indicated a much higher need for talent (24% vs. 12% for larger firms).

Between the Lines:

The lower than expected prioritization of the need for better use of data and advanced analytics, digitizing back-office processes, and investment in innovation could derail many digital transformation efforts.

Organizations of all sizes need to understand the correlation between data and analytics and the ability to deliver a better customer experience or even reduce operating costs. Many organizations are also realizing that simply providing digital functionality is not enough … back office processes as well as an upgrade in digital talent is also needed to meet the expectations of the digital consumer.

Lack of Digital Banking Maturity Threatens Viability of Smaller Firms

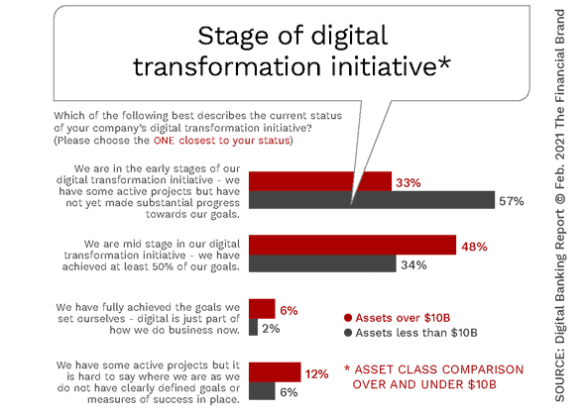

The similarity in perspectives of retail banking trends and priorities between banks larger and smaller than $10B in assets masks the significant gaps in digital banking maturity that exist based on asset size. Some of these gaps reflect leadership and cultural differences, while others reflect a difference in investment in the primary components of digital banking transformation. In either case, as the digital expectations of the marketplace continue to increase, these gaps in maturity could soon impact the viability of hundreds of smaller institutions globally.

When financial institutions were asked about their current stage of digital banking transformation, 57% of organizations with lower than $10B in assets stated that they were in the early stages of transformation, compared to only 33% of organization with more than $10B in assets. While there was very little difference in the percentage of digital banking ‘masters’ based on assets size, 48% of larger organizations believed they were beyond the mid-point in digital banking transformation, compared to only 34% of smaller firms.

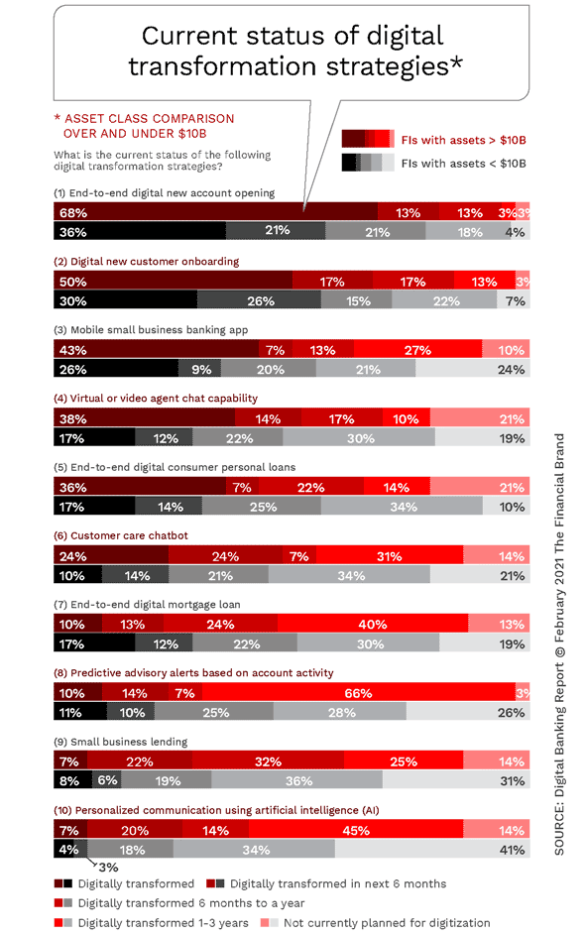

When the Digital Banking Report did a deeper dive into how mature banks and credit unions were in specific digital banking transformation strategies, the differences were startling in almost every category, from digital account opening, to digital onboarding, to customer and member engagement. The smallest difference between small and large organizations were in the categories where virtually no organization is performing well, such as predictive alerts, small business lending and personalization of communication.

What It Means:

With the digital banking maturity gap being so significant, smaller financial institutions must leverage solution providers to enable them to catch up in key areas of digital banking that consumers covet the most.

Can Fintech Collaborations Bridge the Digital Banking Maturity Gap?

While third-party solution providers can assist smaller financial institutions meet the the digital banking needs of an increasingly demanding consumer, the opportunity to collaborate with fintech firms can not be ignored. From the ability to open new accounts or loans quickly, to building savings and investment solutions that replicate the best in the business, fintech firms are not hampered by legacy banking cultures and processes. They also can bring new innovative thinking to organizations that need to look to future needs not yet identified.

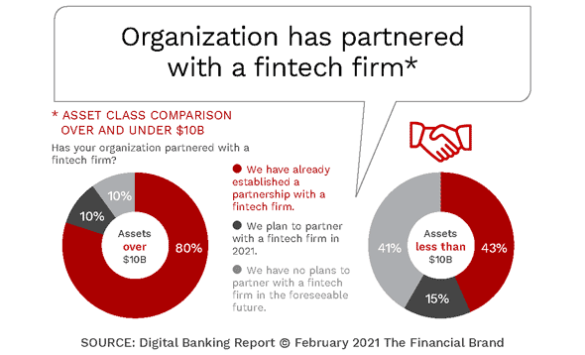

Unfortunately, smaller banks and credit unions severely lag larger financial institutions in their pursuit of fintech collaborations. While 80% of organizations over $10B have already partnered with fintech firms, only 43% of firms under $10B have done the same. Of greater concern is that 41% of smaller banks and credit unions indicated that they have no plans to partner with fintech firms in the foreseeable future (compared to only 10% of larger firms). This places smaller banking organizations at a tremendous disadvantage at a time when these type of collaborations may be the easiest to form.

The Time for Action is NOW

Before the pandemic, larger banking organizations had already moved to provide enhanced digital banking solutions for the masses. From easy new account opening functionality to voice banking solutions, investments were made to shift from the physical to the digital. At the same time, many smaller organizations were comparatively complacent, content with providing excellent in-person experiences, while being slow to respond to an increasing segment of consumers who wanted to do their banking digitally.

The Big Picture:

Smaller financial institutions must leverage the spirit of cooperation and focus on the end goal that was evident immediately after the pandemic hit. While the challenges seem daunting, there is no other option.

When COVID hit, and eliminated all in-person banking, smaller firms were caught off guard, but responded quickly by offering digital capabilities and creating new opportunities. This speed to respond can’t stop despite the improvements made. Now, more than ever, smaller financial institutions must find ways to match the digital maturity of larger firms.

The good news is that third party solution providers and fintech firms can turbo charge the innovation and developmental spirit … assuming current leadership is willing to embrace change, take risks and disrupt the status quo. The process is far more than simply ‘flipping a switch’. It requires entire organizations moving in the same direction to ‘become digital’.