Today In Data: The Three R’s of Payments – Risks, Rewards And Real Time

While children are sitting in schools studying the “real” three Rs (reading, writing and arithmetic), payments peeps will be looking at the local version: risk, rewards and real time. What all three have in common is being on the rise. Businesses want to get paid and get paid faster (or instantly, if possible), and are willing to go the distance to make it happen. Platforms powered by the cloud want to use data to build more rewarding experiences that keep consumers loyal overtime. And managing risk remains a challenge as underwriting is on the rise, in terms of how much money is being lent, the number of entities that are doing the lending and the expanding number of environments in which underwriting and digital payments products are being offered.

Data:

Data:

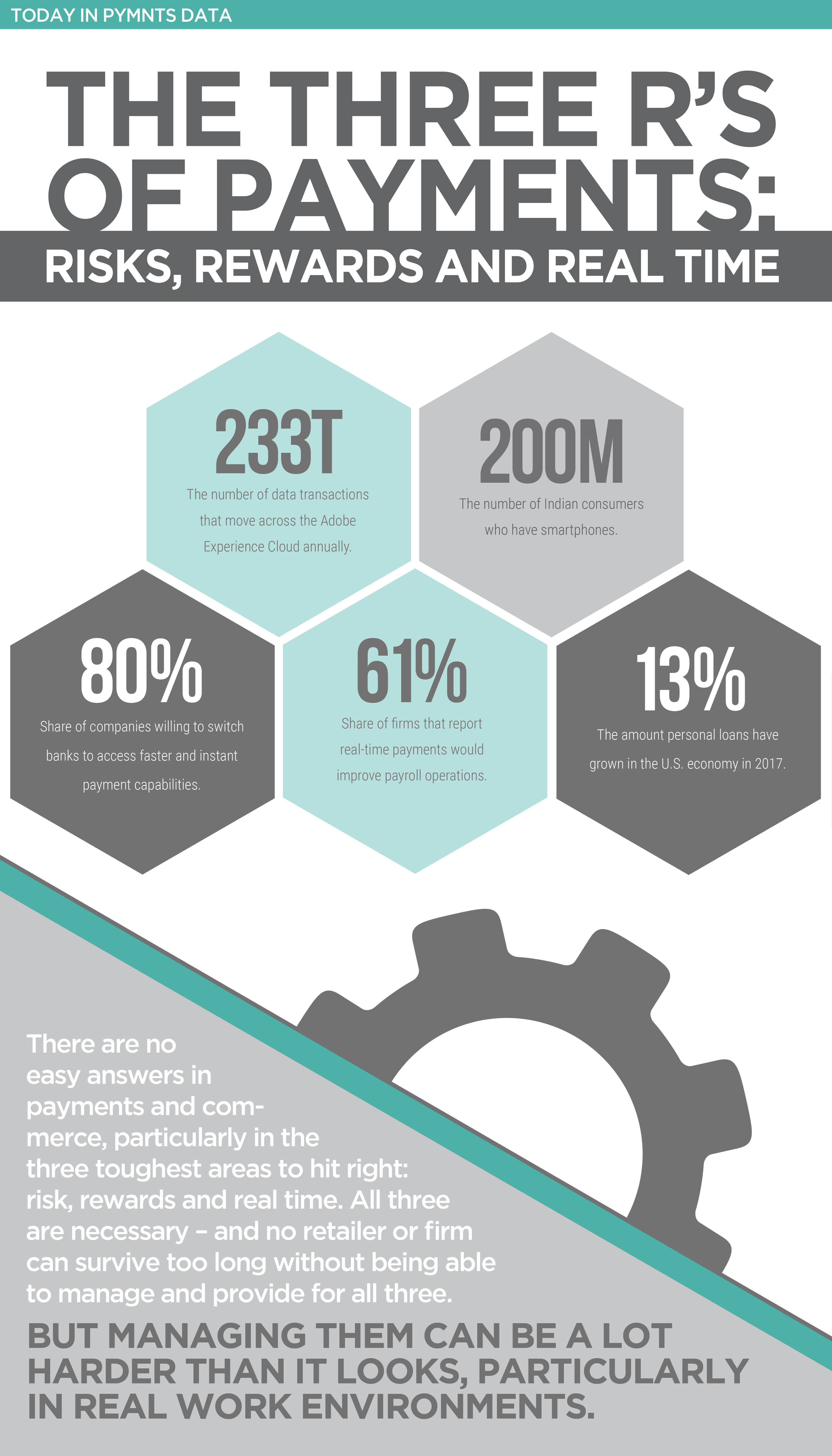

233 trillion: The number of data transactions that move across the Adobe Experience cloud annually.

200 million: The number of Indian consumers who have smartphones.

80 percent: Share of companies willing to switch banks to access faster and instant payment capabilities.

61 percent: Share of firms that report real-time payments would improve payroll operations.

13 percent: The amount personal loans have grown in the U.S. economy in 2017.