I’m not a financial analyst but a technologist and so, unsurprisingly, I got called out by some pedantic accountants over my simplistic assertion that Ant Financial is 35x more productive than banks like Barclays, as I was simply using their revenues per employee to make comparisons. Similarly, in previous discussions of platforms versus banks, using their market capitalisation per employee is also flawed. It does not mean it’s wrong, as I think the platform firms like Amazon and Alibaba are truly transforming business models, but it is not an accurate comparison of productivity. So I drilled down into some more numbers and found the Dupont Analysis (HT to David Eldred) is a better way to make comparisons of companies.

Investopedia describes DuPont analysis as “a method of performance measurement that was started by the DuPont Corporation in the 1920s. With this method, assets are measured at their gross book value rather than at net book value to produce a higher return on equity (ROE). It is also known as DuPont identity. According to DuPont analysis, ROE is affected by three things: operating efficiency, which is measured by profit margin; asset use efficiency, which is measured by total asset turnover; and financial leverage, which is measured by the equity multiplier.

Therefore, DuPont analysis is represented in mathematical form by the following calculation: ROE = Profit Margin x Asset Turnover Ratio x Equity Multiplier.

Now I’m already getting bogged down in detail and don’t want to bore you, dear reader, but it is important to respond to criticism when it is thrown, so here we go.

The average ROE for the largest US firms is around 12%, so the first thing we’re looking for is better than 12% ROE. The higher the figure for asset turnover, the more efficient a firm is with its inventory, so we’re looking for the highest ROA figure*. Similarly, the more leveraged a firm is, the more challenged it will be if funding dried up, so a lower leverage figure is better.

If you want the full primer on Dupont Analysis, then checkout The Financial Intern for a better explanation.

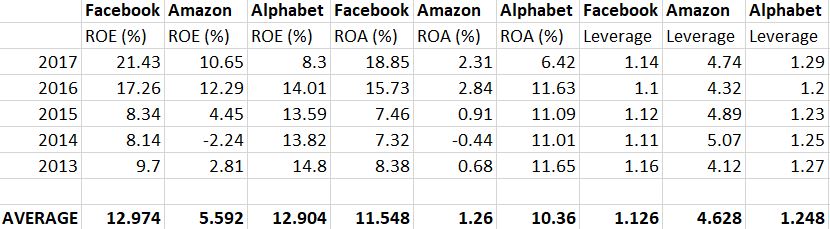

Let’s begin by taking the three biggest US platforms: Facebook, Amazon and Google (Alphabet). Using Dupont’s Analysis we get the following results:

What you can see is that Facebook and Alphabet are similar structures: platform firms that don’t distribute much, other than content, are low leveraged and give slightly better than average return on equity. Having said that, these are not boring firms, as their ROE and ROA swings quite dramatically year-on-year.

Amazon on the other hand is a higher leveraged firm with lower ROE, but their efficiency is shown by their very low ROA. This is a sign of a low-cost distributor. Equally, Amazon has never been that profitable, as they plough nearly all their surplus into expanding their offerings. This is why their ROE is low and leverage is high, as this is still a long-term play to create a monopolistic firm.

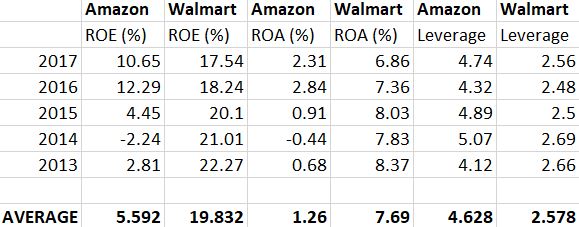

In fact, rather than comparing Amazon and Alphabet, it would be better to compare them with their arch US rival incumbent, Walmart, and what you find then is that Walmart’s results are way better.

Having said that, I know which firm I would invest in.

Now let’s take the top three US banks: JPMorgan, Bank of America and Wells Fargo. Truth be told, I found it hard to track down a decent analysis of these banks. as the figures showed above 20% average ROE pre-2008’s crisis sinking to flat-lining for a few years before picking up again. Nevertheless, here are the latest stats sourced from MorningStar:

These results show that Wells Fargo is the best performing big bank in America, whilst Bank of America is underperforming.

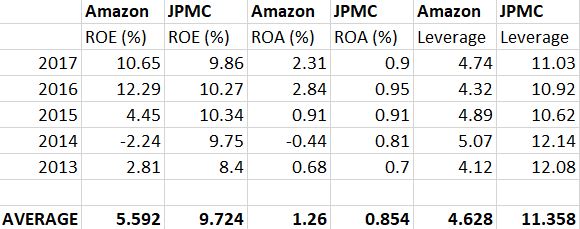

All in all, what does this tell me though? For the financial investors and analysts, it tells them which companies in which sectors to invest in, but does it actually give me any meaningful comparisons across sectors? Does it give me a clear view of how Amazon stacks up against JPMorgan?

Financially, yes; strategically, no.

I realise that the nit-pickers out there don’t like it when I say that Stripe generates 22x more value per employee than JPMorgan Chase, based upon their last funding round valuation; or that Ant Financial is 35x more productive than Barclays Bank, based upon revenues per employee. They want their Dupont Analysis of these companies so that they can say, ah yes, Amazon and Alibaba are highly leveraged, but JPMorgan and Wells Fargo are strong and stable. I think that misses the point however, and the point is: which company/companies will dominate the next century?

I’m not betting on Walmart or Bank of America.

POSTNOTE: Whilst researching this blog update, I also found a quite dated but intriguing Dupont comparison of the world’s systemically important banks. If you want to know more, click here.

COMMENT: Former banker Miguel makes a great comment: "ROA is calculated as Net Income divided by the Average of Total Assets. Therefore, the higher the ROA, the more income you are generating out of your assets -- this is actually good, not bad. Higher ROA is desirable, not lower ROA. This means that as a firm, you are able to use your assets more efficiently. One flaw in the ROA calculation is that it is based on Assets, which are typically accounted for at historical values. On the other hand, for banks, the formula works well and it is used to evaluate them since the assets for banks are usually accounted for at market value."

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...