Other parts of this series:

Banks, by and large, should be proud of how they’ve handled the early stages of the COVID-19 crisis—shifting quickly to remote working and helping provide customers with much-needed liquidity and financial support. More changes lie ahead. Some will be hard to predict (such as whether the public health crisis will be a one-off or recurring event) and others easier (such as fewer bank branches and higher levels of digital banking interaction).

Banks, by and large, should be proud of how they’ve handled the early stages of the COVID-19 crisis—shifting quickly to remote working and helping provide customers with much-needed liquidity and financial support. More changes lie ahead. Some will be hard to predict (such as whether the public health crisis will be a one-off or recurring event) and others easier (such as fewer bank branches and higher levels of digital banking interaction).

Unlike 2008, banks are not responsible for creating this predicament. So, by helping their customers navigate the uncertainty and get through the crisis with minimal financial damage, they have the opportunity to emerge as the heroes who save the day.

An important part of becoming heroes will be reassessing and redefining their core purpose in a way that puts customers authentically at the center of everything they do.

My colleague Michael Abbott and I discussed this realignment in our recent Purpose-Driven Banking webinar. We drew on our two-part research study, which shows that customers and banks both need the shift to happen.

For example, of the nearly 14,000 consumers we polled prior to COVID-19, 42 percent were already finding it difficult to manage their money. They either were not sufficiently knowledgeable on financial topics (44 percent) or were confused by complex finance-related rules (40 percent). And it wasn’t only consumers who were struggling—a different survey found that more than 70 percent of small and medium enterprises (SMEs) could not meet their financial needs by borrowing from traditional banks.

For example, of the nearly 14,000 consumers we polled prior to COVID-19, 42 percent were already finding it difficult to manage their money. They either were not sufficiently knowledgeable on financial topics (44 percent) or were confused by complex finance-related rules (40 percent). And it wasn’t only consumers who were struggling—a different survey found that more than 70 percent of small and medium enterprises (SMEs) could not meet their financial needs by borrowing from traditional banks.

In April, about six weeks after the pandemic struck, we followed up that research with another study. The 5,500 consumers and 1,300 small-business executives who responded confirmed that, unsurprisingly, the situation had gotten worse. Forty-two percent of consumers reported a negative impact on their finances, while 55 percent of sole proprietors and small enterprises, and 42 percent of medium enterprises said their sales had declined significantly or they had totally closed their doors.

Clearly, consumers and small businesses need assistance from their banks now more than ever. Yet despite their rising financial stress, relatively few customers turn to their banks for advice. For example, 58 percent of SMEs go to a professional services firm for advice about their business finances, compared to 35 percent who consult their bank. Nearly one-third of consumers turn to friends and family for help when hit by a life event with serious financial implications but a mere 14 percent ask their bank for help.

The issue is trust. Customers trust banks to protect their data and process their transactions, but only 43 percent trust them to help look after their long-term financial well-being. Despite banks having played a key role during the early stages of the health crisis to help their customers, relatively few consumers and small businesses trust their bank more as a consequence; those who do are offset by similar numbers who trust their bank less. So banks, currently, are not moving the needle ahead much in the area of advisory trust.

Purpose-Driven Banking 2021 report: Driving powerful transformation for banks.

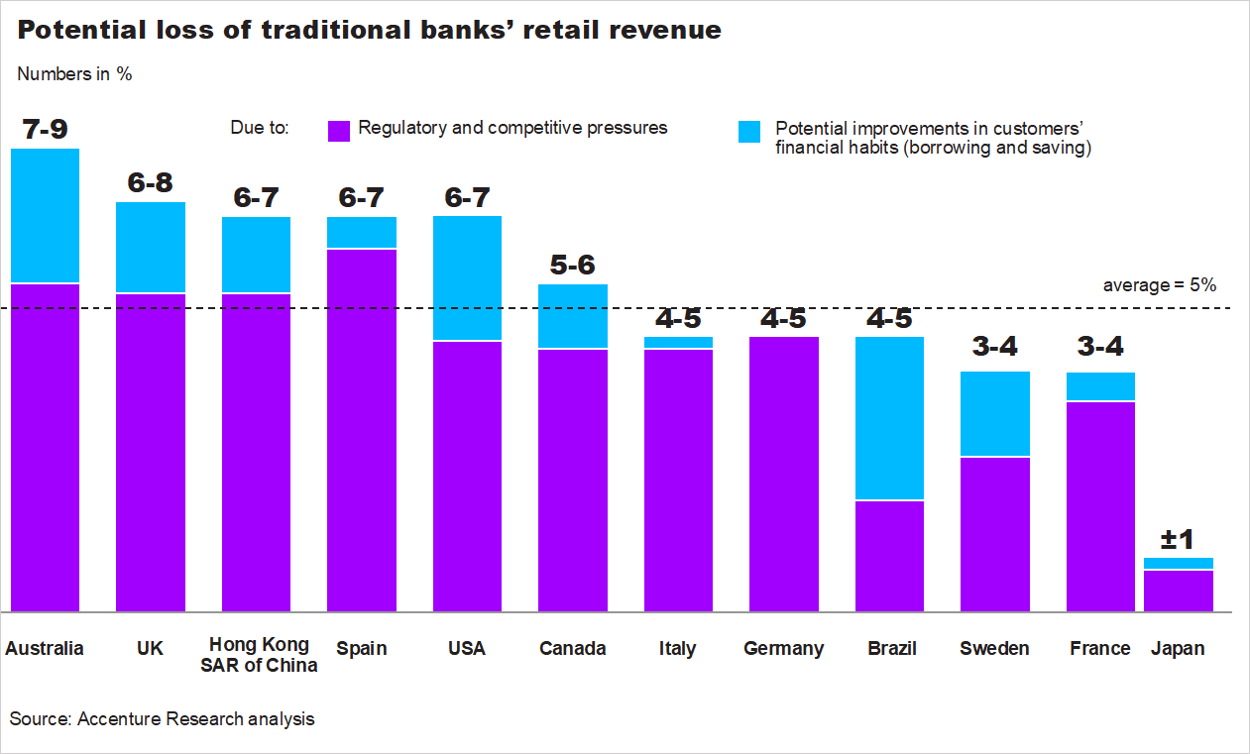

LEARN MOREAt the same time, because of this lack of trust, banks face the potential erosion of their revenue. Traditional banks derive substantial income each year from hidden and obscure fees (such as cross-border payments and account maintenance charges) and fees associated with customers’ sub-optimal decisions (such as not transferring funds to a savings account or using a high-interest credit card instead of a lower-interest consumer loan). These “gotcha” moments are likely to become rarer as they are targeted by regulators and new digital competitors alike.

Based on our survey and analysis of 12 key markets, these fees and charges represent a global average of five percent of retail banks’ total revenues (shown in the figure below), which is now at risk.

In my next post, I will share how I believe banks can address this threat to their revenue—and in the process boost their revenue by nine percent over the next five years. It starts with shifting their purpose toward a win-win model that builds advisory trust.

Until then, learn more about our survey findings and market analysis in our Purpose-Driven Banking: Looking Beyond COVID-19 report and webinar. Afterwards, weigh in with your thoughts here.